Grandmother and grandson who had sepsis at same time ‘lucky to be alive’

A grandmother who contracted sepsis which made her hallucinate, have “blotchy skin” and turn the “colour of stone” later found out that her four-year-old grandson had the condition and Strep A at the same time as her, with the pair being “lucky to be alive”. Lorna Conaghan, 63, a retired business control analyst from Gourock, Scotland, and her grandson, Alfie Crawford, four, had sepsis at the same time, and Lorna “just couldn’t believe it”. In September 2022, Lorna was due to have a shoulder replacement, but on the morning of the surgery, she “did not feel right” and felt “on edge and weak” – but put it down to nerves. Little did she know this was her first warning sign of sepsis. After informing the doctors, they soon realised that one of her organs was infected and she was admitted to the hospital’s high dependency unit. The following day, Lorna was diagnosed with sepsis as her skin began to look mottled, and doctors told her that she “would have been dead” if it was caught any later. After having antibiotics and a few more hospital visits, Lorna began to recover, but it has taken her 11 months to “go back to normal” and have regulated blood pressure. When Lorna was in hospital, her grandson Alfie, who was three at the time, had chicken pox and a cold, which developed into sepsis and Strep A. Lorna thinks that because Alfie’s mum knew about her symptoms of sepsis, it helped her realise something was wrong. Alfie’s lungs were “full of pus”, so he was put on a ventilator and was in an induced coma for over a week. He also had to “learn to walk again”, and slowly has been able to make a full recovery – with Lorna saying the family are “so lucky to still have him”. Lorna told PA Real Life: “Alfie got sick when I was in hospital, and when I found out I just couldn’t believe it. “I think me having sepsis made Alfie’s mum realise that he had more than just a cold and chicken pox. “We’re both so lucky to still be here and that Alfie is back to running around and having balls of energy.” On July 4 2022, Lorna broke her arm after slipping on her dog’s tennis ball and ended up needing a shoulder replacement. On the day of the surgery, September 30 2022, at Inverclyde Royal Hospital, Greenock, she began to “not feel right” but put it down to nerves. She said: “I told the doctors and they tested me for Covid, but I was negative, and after a few more tests they thought one of my organs might be infected. “They thought it was my heart to begin with, but they couldn’t figure out what organ it was. “The biochemist worked out which antibiotic would best kill the infection, so I was put on that straight away.” Lorna stayed in the hospital for nine days, with seven of them being on the high dependency unit. She said: “They thought it was my kidneys, so they were trying to get them functioning again. “With hindsight, it was terrifying, but I didn’t realise how serious it was at the time. “I was a strange colour, the colour of stone, and I was all blotchy. “Doctors said if they caught it much later, or if I wasn’t in hospital, I would have been dead.” Four weeks later, Lorna was admitted to the high dependency unit again after her GP noticed she had extremely low blood pressure and low heart rate. She said: “I was so confused – when family members would visit me, I’d ask them to leave because I was hallucinating and didn’t want them to see me like that. “I thought there was a castle outside the hospital – I thought I was seeing it outside my window, and I remember thinking that we’ll have to go there once I’m out of hospital.” Since then, it has taken Lorna 11 months to get “back to normal” and her blood pressure regulated. She said: “I’m still having problems with my liver, but now I’m just tired. It’s really taken it out of me. I can only take the dog so far, I’m just so tired all the time.” While Lorna was in hospital, Alfie’s mum informed her that he was feeling unwell. Stephanie did not want to worry Lorna when she was already sick, but it turned out that Alfie, who was three at the time, had also contracted sepsis. Lorna said: “He came home from nursery with chicken pox, and also had a bit of a cold. “Then it just got worse – he was having terrible pains in his back, and I think Stephanie had just listened to what I had said about my symptoms, and it made her realise subconsciously that he might be more unwell than he is coming across. “They called the paramedics, and that night he got a lot worse – when they arrived at A&E, she took him up to the desk and said, ‘We’re going to have a dead child if we don’t do something’.” Within half an hour, Alfie was admitted to intensive care at Glasgow Children’s Hospital and doctors soon realised his lungs were “full of pus” and that he had sepsis, which had turned into Strep A. So, Alfie was put on a ventilator and was in an induced coma for over a week. “Doctors made it clear to Alfie’s family that it was indeed life-threatening and that he was very lucky to be alive Lorna Conaghan Lorna said: “He had to learn to walk again – he was so weak after he woke up. “Doctors made it clear to Alfie’s family that it was indeed life-threatening and that he was very lucky to be alive. “His legs were so weak – he hadn’t eaten much while being poorly.” After having antibiotics and being in the induced coma, Alfie is now “running around”. Lorna said: “With me, I’ve had a good life, but it was so unfair to think that little Alfie could have died – he hasn’t had a life yet. “We’re just so lucky to still have him with us. “This whole experience has made me appreciate everything – when I take the dog for a walk I have a sit down on the bench and take in all the lovely scenery. “I have treated every day since Alfie and I got better as a bonus day in my life.” Read More Amy Dowden reveals ‘life-threatening’ sepsis diagnosis amid cancer treatment BBC Radio 2’s Tony Blackburn reveals he had sepsis and pneumonia in health update Martha Mills: Parents of girl who died after NHS mistakes call for new right to get second opinion Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live

2023-09-06 22:57

Fall music releases: Pop powerhouses, country classics, hip-hop heavyweights and beyond

Music fans, it is time to bid adieu to the sunny, slow summer months

2023-09-06 22:51

What Happens to Unsold Halloween Pumpkins?

The unwanted gourds can wind up in a variety of places, including your local zoo.

2023-09-06 22:19

Venice entry fee will start next year

After talking about an entrance fee for several years, the Venetian authorities have now confirmed that a pilot project charging day-trippers will begin in spring 2024. Visitors will pay 5 euros to enter the city on busy days.

2023-09-06 21:46

Divorce after 60: What happens to your health benefits?

Research shows that more than 1 in 3 people who divorce in the U.S. are age 50 or older, and 1 in 4 are 65 or older

2023-09-06 21:46

One in 10 ‘spending beyond their means’ – try these 7 cutbacks guaranteed to save families money

Times are hard, and it’s no surprise to learn many people are spending more than they earn. New research has found one in 10 people spend more than they have in their current account at least seven months each year, and more than half (59%) spend more than they earn at least one month a year. The research, for website TopCashback, also revealed that while parents with children under 18 typically have just £179 left in the bank the day before payday, nearly three-quarters (73%) of people feel they don’t have their spending fully under control, with nearly half (47%) citing the rising cost of living as the cause. And around two-fifths (41%) admit they feel anxious about the cost of living on a weekly basis. “So many people are guilty of spending above their means – let’s face it, it’s why credit cards are such big business,” says finance expert Vicky Parry, head of content at MoneyMagpie. She says emotional spending can be a real issue, pointing out: “When we feel deprived of something, it makes us seek out that dopamine to feel good, so we online shop, and we buy things we don’t even need.” And Rajan Lakhani, a money expert at the smart money app Plum, says: “With wage growth now beginning to exceed rising costs, households may be tempted to spend even more.” But he stresses it’s important to try to get any high interest debts down before succumbing to spending temptations, and notes there are plenty of easy ways for families to reduce their spending. Here, Parry and Lakhani outline their tips for family cutbacks as the cost-of-living crisis continues to bite… 1. Avoid brands Parry advises families to stop buying branded goods in the supermarket, pointing out that the mark-up can be huge. “More often than not, it’s made in the same factory as the supermarket’s own-brand product,” she says. “If you equate a brand as a stamp of good quality, then try to change this mindset – look at the taste awards and you’ll see many own-brand and cheaper products are superior.” 2. Get the kids involved with cutting energy bills If they’re old enough to understand, talk to your kids about why it’s important to switch off lights when they leave a room, and why the heating might not be on as much when winter comes. Lakhani says: “As a dad, I’m having to constantly tell my eldest daughter to switch off the lights when she’s left the room. That helps in the short-term, but explaining to children why it’s important to do this, whether it’s the benefits for household bills or the environment, means they’re more likely to remember.” He says smart meters also provide a fun way to bring cost-saving to life for kids, as they can see the impact of switching off lights or turning off appliances that aren’t being used. “It becomes a game for them, and you can create competitions around who’s being the most energy-efficient,” he suggests, pointing out that children’s help could make an important difference, as although energy bills have fallen, prices are still far higher than they were at the start of last year. 3. Budget Keeping your eyes firmly on a budget is the first step towards stopping overspending, stresses Parry, who points out there are some good budgeting apps that tell you what your monthly budgets should be. “Have lists of items you want, items you need and items that will make your life easier,” she suggests. “If you see a top in the sale, yet ‘top’ isn’t on those lists, you’re being impulsive. It’s a good way to remember what you genuinely need.” Lakhani says it’s crucial to budget in the supermarket, and families need to “develop your special superpower” against clever in-store marketing ploys. “Have a set budget and shopping list, and ringfence how much you want to spend on groceries,” he advises. He suggests buying groceries online can help with set budgets, because you can see how the costs are totting up as you put them in your virtual trolley. “Buying groceries online also reduces the chances of being tempted by impulse purchases and kids asking for extra things, while also being easier to find offers,” he says. 4. Childcare share After-school clubs may be a necessity for some parents, but the cost can be crippling – Parry points out that the average fee for an after-school club is usually between £8-£15.50 per session, so five days a week for the 39 weeks of the school year can cost as much as £2,925 per child per year. But you can cut that cost completely, she says, by getting a group of trusted parent friends together and taking it in turns to have all the children over after school for one night each a week. 5. Walk more Although it’s often tempting to use the car for short trips like the school run, Lakhani stresses: “Walking the kids to school is not only good for your pocket, but for the planet and your health. It also gives you more face-to-face time with your children, so you have more time to know how they’re feeling and what’s going on at school. “With petrol costs on the rise again as oil prices are increasing, this is a relatively simple way to cut your costs.” 6. Beware of hobby stacking Hobby stacking is when kids develop a passion for a particular pastime, and then forget it and move on to another within a few weeks. “Before you go out and buy all the kit and gear for something which is essentially a phase, try and borrow it from a friend, or make do, until you’re sure this passion is a long-term investment,” Parry advises. 7. Cut nappy costs If you’ve got a baby, nappies can cost a small fortune, but Lakhani says you can save money by buying them in bulk or having a subscription, which are often discounted. “If you’re buying in bulk,” he says, “ensure you don’t purchase too many, as you could be left with nappies that are the wrong size as your baby grows.” In addition, compare the price of nappies at different retailers, or for an even cheaper option, use reusable nappies. Not only are they cheaper (in the long run), but they’re better for the planet too. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live What is combination cholesterol therapy, as study suggests it could save lives? Cancer cases in young people ‘are rising’ – the warning signs to look out for How construction expert Daniel Ashville Louisy went from social media star to TV host

2023-09-06 21:29

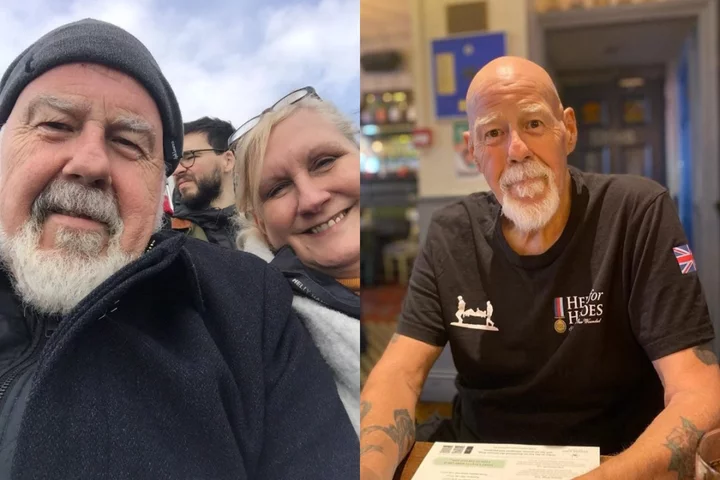

Cancer-hit dad who planned his own funeral defies doctors’ three-week life expectancy prognosis

A father-of-three who was told he looked like “Casper the ghost” before being diagnosed with acute myeloid leukaemia (AML) and given three weeks to live, meaning he has planned his own Requiem Mass and funeral, has defied doctors’ expectations by outliving his prognosis by more than a year and said he is going to “keep fighting”. Dennis Blackman, 62, a former chartered building surveyor and carer who lives in Eltham, London, said he has always been active – playing rugby, lifting weights, and going to the gym at least three times a week. However this all changed when he suffered an unexpected stroke in 2015. His health deteriorated over the following years, he had a hip replacement at 58, and after experiencing symptoms of extreme exhaustion, cold hands, and muscle weakness in early 2022, his wife Sally, 62, a former flooring showroom manager, suggested he book a doctor’s appointment. After weeks of blood tests and blood transfusions in hospital and being told he looked like “Casper the ghost” because he was so pale, he underwent a bone marrow biopsy, and this led to the devastating news in March 2022 that he has AML – a type of blood cancer – and three weeks to live. Dennis told PA Real Life: “I just broke down and I had this unbelievable feeling of guilt because I said to the consultant: ‘What have I done wrong? How do I tell my children and wife?’ “It’s a huge burden to put on someone, to tell them that you’re dying and it’s going to be very quick. “We had many dark days, and every time I looked into my children’s eyes I just burst into tears… it was a very emotional period for all of us.” Dennis, who has lost 50kg (7st 9lbs) since his diagnosis, did not start chemotherapy until months later due to him being too weak, and in January 2023, he was told the chemotherapy was “not working any more”. From that point on, he said he wanted to “enjoy each day” rather than pursuing more aggressive forms of treatment – and since then, he has planned his own Requiem Mass with hymns such as How Great Thou Art and Ave Maria (As I Kneel Before You), as well as the arrangements for his funeral. Now, Dennis continues to drive, go shopping, and enjoy time with his family, and he said he is going to “keep fighting” during the time he has left as “you only have one life”. “Every day you go to bed and you think: ‘Am I going to wake up tomorrow?’ And then each morning you think: ‘Is it going to be today that I’m going to die?’” Dennis explained. “It was extremely difficult in the beginning and I tried to shut the world out… but as time went on, I realised you can’t live like this forever. “You only get one life, so I’m going to do everything I can to keep fighting.” During his 40s and early 50s, Dennis said he enjoyed going out for meals with his wife Sally, playing rugby with his sons James, 37, and Joe, 31, and keeping fit by going to the gym several times a week. He foresaw spending his days in retirement with his family, out in the garden, or fishing, but he said this all changed when he had a stroke in 2015, aged 54, and his health declined from then on. In early 2022, he spent six weeks at Queen Elizabeth Hospital in London after noticing some unusual symptoms and was told: “You look like Casper (the ghost), you’re very anaemic.” He then underwent several blood tests and blood transfusions, and although he had “an idea” that he may have cancer, he said he could never have prepared himself for his diagnosis on March 31 2022. “About one o’clock, I had a knock at the door and I thought: ‘That’s ominous’,” Dennis said. “The consultant and the specialist nurse came in and they said: ‘Unfortunately it’s bad news, you’ve got severe AML and there’s not a lot we can do at this stage.’ “’You’ve got three weeks to live, and I’d advise you to go home and tell your wife and family, and make sure everything’s in order because you haven’t got long left’.” Given Dennis has severe neutropenia as well – a low number of white blood cells – he is at a higher risk of contracting serious infections, and this meant he missed several family celebrations in the months that followed, including his grandson’s birthday party and stepdaughter’s wedding. He developed multiple chest infections and fevers and was not deemed fit enough to start chemotherapy straight away, and he ended up spending three months in hospital from July to October. “We thought we were going to lose him, he was so ill,” Sally, who has been married to Dennis for 10 years, explained. “Even the consultant thought we were going to lose him. “I was scared because I just thought: ‘How can this be happening when we’ve only just met each other?’ We just thought we were going to have the rest of our lives together.” However, Dennis, who is Catholic, said he “fought and prayed every day”, adding: “I said to the consultant: ‘If you promise to me you won’t give up on me medically, I promise I’ll fight this all the way.’” Dennis was determined to get better and, with the help of a physiotherapist, he built up his strength – and at one point, he was walking 10,000 steps a day along the hospital corridor. Towards the end of October 2022, Dennis said “everything seemed hunky dory” and he commenced the first of four rounds of chemotherapy, where he experienced nausea, exhaustion, and “tremendous leg bone pain”. By January, he was told the chemotherapy was “not working”, but rather than trying other forms of treatment, he said he wanted to “enjoy the little things” and the time he has left. He has planned his own Requiem Mass and funeral to relieve any pressure from his family, but also to give him “strength” and some control over his destiny – and aside from his regular check-ups and blood tests each week, he is setting himself small milestones, such as attending a Madness concert at the O2 in December. Although he is “struggling to survive”, he said he would do “anything to get another day” – and that is why he is holding onto hope and wants to encourage others never to give up. “Even though I pray every day, not once have I asked God to take it away from me – all I ask is that He’s with me when I need him, to give me the strength to carry on fighting,” he said. “Leukaemia is painful and every day I question whether I’ll see another day, but we just try and keep going and I hope that my story gives hope to others. “I’ve still got lots of memories to make yet, so I’m going to fight this all the way.” For more information and support, visit Leukaemia Care’s website at leukaemiacare.org.uk Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live One in 10 ‘spending beyond their means’ – try these 7 cutbacks guaranteed to save families money What is combination cholesterol therapy, as study suggests it could save lives? Cancer cases in young people ‘are rising’ – the warning signs to look out for

2023-09-06 21:27

Edmunds: The best affordable performance cars

There’s often a point when car enthusiasts are looking to purchase their first new performance car or sports car

2023-09-06 18:46

Starmer Says Sunak Prioritized Champagne Tax Cut Over UK Schools

Rishi Sunak prioritized cutting tax on champagne rather than provide extra funding to rebuild British schools when he

2023-09-06 18:22

Is bottomless prosecco going to be killed off by climate change?

Picture this. The group chat has finally settled on a date and we are going out. Out out. Women of most ages know how serious this is. There was probably a spreadsheet involved. Boyfriends and husbands have been dispatched to the pub. Children and dogs have been dropped off at the sitter. Dignity has been left at the door. One of us is waiting for it to be cancelled so we can stay at home with our loungewear and girl dinners (it’s probably me). There’s only one thing for it. Bottomless brunch. Many Asos orders and outfit changes later, we arrive, take our seats and start the binge drinking timer. There’s only one problem. No prosecco. Freshly manicured fists pound the table. The elected Karen of the group starts to verbally pulverise the staff. Eggs Benedicts are thrown against the walls. The Prosecco Huns exclaim in unison: “But what are we going to drink now?!” The waiter bashfully suggests: “Spumante?” Give over. According to a new study, this could be a reality in the near future thanks to climate change threatening vineyards across Europe, in particular those dedicated to glera (the beloved prosecco grape) in Northern Italy. In a detailed report in iScience last month, researchers warned that unpredictable weather, soil degradation and drought could lead to the loss of a millennia-old winemaking tradition, and the livelihoods attached to it. RIP the Prosecco Hun. The Italian sparkling wine has long been the fizz of choice in the UK (we were only dethroned as the world’s biggest prosecco guzzlers last year by the US). In the early 2010s, more than a third of all the prosecco shipped out of Italy worldwide ended up in Britain – approximately 131 million bottles a year. That’s nearly two bottles per Brit. You get the idea. The origin of our obsession with prosecco dates back to just after the 2008 crash, when consumers were looking for an alternative to expensive champagne. The softer tasting, far more affordable (thanks to its cheaper and speedier production time) and incredibly quaffable prosecco was the obvious choice. Bottomless brunch was born. “My heart goes out to the huns whose weekends simply aren’t complete without a bottle of prosecco,” Hannah Crosbie, founder of Dalston Wine Club, laments at the news that just 15 years after it stormed onto supermarket shelves, prosecco might be quietly forced to say arrivederci. “In all seriousness though, climate change is seriously threatening every aspect of winemaking, and growing conditions are only getting more challenging.” Prosecco is certainly not the only vino at risk, but it faces a unique issue. Where other wine growing regions affected by climate change such as Champagne and Burgundy can simply put out a limited run with an inflated price tag and keep the snobby oenophiles coming, prosecco’s USP is its ability to produce in bulk and at a fraction of the cost. English sparkling is a big winner with the climate going the way it is. Prosecco, by all accounts, seems like it’s a bit of a loser in that regard Will Amherst, head wine buyer at Trullo Ali Finch, group sommelier at Angela Hartnett’s Michelin-starred Italian restaurant Murano in Mayfair, doesn’t believe there’s an appetite for a higher quality, more expensive prosecco. “With the impact of the climate as well as the cost of producing wine increasing, the challenge for prosecco is going to be how to balance the expectation of its price point with the need to make slightly smaller quantities,” she tells me. “Regions like Chablis, for instance, have had multiple horrible vintages back to back and people just accept the fact they have to pay more for it if they want to drink that wine.” For the uninitiated, the word “vintage” on a wine label simply means the year the grapes were harvested – compared to regular wines that may include grapes harvested in multiple years – and each vintage can taste vastly different based on the conditions affecting the grapes in that year. Chablis, produced from chardonnay grapes in the northernmost district of Burgundy, has always been particularly affected by the climate due to its geography, but in recent years has seen frost in 2016, 2017 and 2021, and drought and higher temperatures in 2019 and 2020. This has dramatically affected those vintages, and driven up the price of bottles from “good” years. But with prosecco, “people potentially wouldn’t be interested in” paying a higher price, Finch says. This is partly because its brand has become more associated with cheap fizz than fine wine in Britain. Part of the problem also lies in the simplicity of its production. Prosecco is a wine that reflects the aromatics of the grape at the point of harvest, whereas with other sparkling wines like champagne, as well as other types of wine in general, such as chablis, it’s about the ageing process. Rising temperatures mean grapes are ripening more quickly, which can result in a different flavour of wine or too much alcohol, so one option is to harvest the grapes earlier. You can get away with a slightly under-ripe fruit in aged wines as so much of the flavour is added during their long fermentations. In prosecco, a bottle of which is ready in just 30 days, an under-ripe grape could result in something that “tastes a lot like battery acid”, according to Finch. The Prosecco Huns don’t want to chug something flavourless and eye-wateringly alcoholic with their eggs Benedict. “If you pick too early, you’ve got no flavour,” Finch explains. “So they don’t really have the option to just keep making it in the same volume. With other wines, you can do more work in the winery to make the wine feel more balanced and more approachable and more complex. They don’t have that luxury in prosecco.” Under Italy’s DOC (Denominazione di Origine Controllata) laws, prosecco is only prosecco when it comes from just two regions of the country, Veneto and Friuli-Venezia Giulia, and adheres to strict growing and production rules. The same goes for champagne: only wine produced from eight permitted varieties of grape grown exclusively in the Champagne region of France may be called champagne. It’s these “heroic viticulture” sites that the report says are most at risk. Naming rights have been a point of contention across the whole wine industry for some time, with Australian producers of glera recently putting in a request to the EU to be allowed to call their wine prosecco on the grounds that it’s part of their migrant and cultural identity. Ironically, the glera grape is actually believed to be Slovenian in origin, and was first cultivated in the vineyards of Prosecco, a small village in the Friuli-Venezia Giulia region near the border with Slovenia. The name is even thought to derive from the Slovenian words preseka or poseka, or the Serbian/Croatian prosek, meaning “path cut through the woods”. While DOC laws might prevent anyone calling a sparkling wine made from glera grapes outside of the designated regions a prosecco, it hasn’t stopped winemakers around the world from essentially producing the same wine using the same techniques. As climate change has made it increasingly difficult to cultivate the grapes in their historical home, it’s also made conditions in more northern regions like the UK more favourable for the growing of certain grapes, including white varieties such as glera, opening the door to a whole new generation of winemakers. “This is not me saying this is the death of prosecco,” Finch adds quickly, but she stresses that the wine industry is naturally very dynamic. “There are loads of alternatives to prosecco, both within Europe in terms of pet nats and cremants and things like that, and with the New World as well.” Pet nats – sparkling wines made using the “traditional method” of fermenting in individual bottles – have become very trendy among the younger Gen Z crowd, she says, as it still offers something bright, fruity and super fizzy, but without the faff, or price tag, that comes with champagne. People are also drinking less but are happy to spend a little more and not drink as much. At Murano, Finch says diners are asking about English sparkling wines more than ever before. “The correlation, obviously, with post-Brexit is there. There’s a desire to try and drink more local wines, potentially from a sustainability point of view, potentially from a cost-to-quality point of view because of duty increasing. It’s also partly because during Covid people did a lot of staycations and UK wine tourism did very well during that time. And it sort of stuck.” It’s a sentiment echoed by Will Amherst, head wine buyer at Italian trattoria Trullo in Islington, north London. “I don’t want to bash prosecco too much, but if I was going out and I wanted sparkling wine, I would still look at champagne,” he says, much to the chagrin of the Prosecco Huns. “And if I’m going to look somewhere other than that, I would get a bottle of English sparkling. Because English sparkling is a big winner with the climate going the way it is. Prosecco, by all accounts, seems like it’s a bit of a loser in that regard.” Prosecco and the people that produce it are certainly not the only losers but its high-altitude, cooler temperature geography, which previously protected it from climate change, is now adversely affected by extreme weather. Sudden, intense rainfall damages the soil and creates “slope failures”, while conversely droughts make irrigation extremely difficult. While he’s yet to see a knock-on effect on prosecco supplies at Trullo, Amherst’s “immediate thoughts were, really sadly: is prosecco going to be able to pull itself out of that hole? I don’t know how you reconcile the spiralling production costs and the brand identity, which is synonymous with cheap wine in this country,” he says. Although it’s not recommended to keep prosecco longer than two to three years before it goes flat – compared to up to 10 years for vintage champagnes – he doesn’t anticipate stocks to run down soon. At any rate, his biggest use for prosecco at Trullo is in an Aperol Spritz, where it makes up half the drink. He actually sees it as an exciting opportunity for new wines to emerge. So does Will Hill, a wine buyer at online merchant Honest Grapes, who tells me: “Once again, cava is showing that there is great value to be found in traditional method sparkling wines and more and more we are seeing ‘prosecco-esque’ wines for lower prices. If the consumer isn’t tied to the name ‘prosecco’, there are plenty of good, affordable, entry-level options available.” It’s clear that wines of all colours are facing an uphill battle (quite literally in prosecco’s case), not just to survive but to protect their identity, which for prosecco is arguably more important. That could spell the end of the Prosecco Hun, but with English sparkling and other European varieties on the rise, perhaps it just means a rebranding is in order. Cremant Crew? Pet Nat Posse? They don’t have quite the same ring, but it won’t stop us booking bottomless brunch anytime soon. Read More I feel it in my fingers: Why more of us should start eating with our hands Pizza, cake and meringue martinis: When did cinema food get so silly? Michelin-starred chef Simon Rogan on 20 years of L’Enclume: ‘It all started with a radish’

2023-09-06 15:29

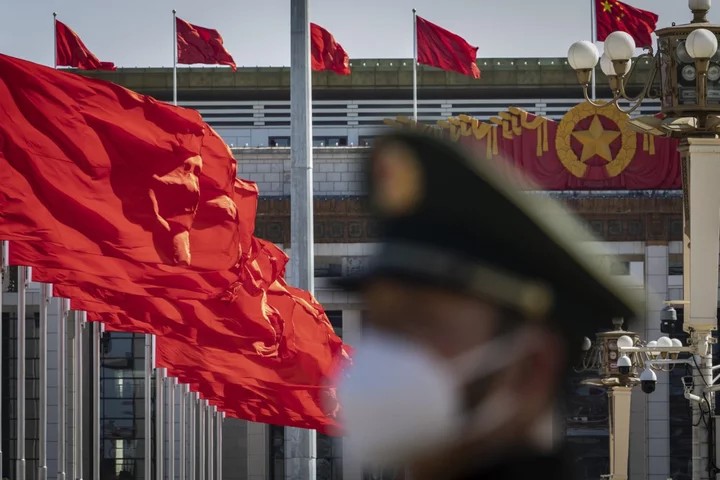

China Considers Law Banning Clothes That ‘Hurt Feelings’ of Others

China’s public is expressing concern about a potential legal change that would allow for fines and even jail

2023-09-06 14:47

Hermine Dossou: Being thrifty in the kitchen helped me get on the housing ladder

As a trained accountant and a long-time baking enthusiast, Hermine Dossou knows a thing or two about saving money in the kitchen. “My first breadmaker was from Panasonic – I bought it from Gumtree,” the former Great British Bake Off contestant says. “It was basically somebody’s wedding present that they didn’t want and they sold it half price.” A devotee of Martin Lewis’s Money Saving Expert website, the 42-year-old, who was born in Benin, West Africa, and moved to the UK for university aged 20, tries to avoid ever paying full price for a big ticket item. “If I wanted to buy, let’s say, a mixer, I would go online, and type ‘Kenwood discount vouchers’ and then something always comes up,” says Dossou, who lives in Kettering and came fourth on the 2020 series of Bake Off. But the mum-of-one – whose son Steven is 13 – wasn’t always such a frugal foodie. “That came from that period where I became a single mum on a reduced income,” she says. “I couldn’t work full-time because I had to look after my son, and also I didn’t want him to have the processed kind of bakes.” Whipping up cakes and cookies filled her “empty afternoons” as a new mum and was a lot cheaper than buying ready-made baked goods. “I would cook from scratch and prep my vegetables when I could get them on offer,” she continues. “Same for fruits – they are often very discounted when they become a bit soft, and that’s the best time to make jam.” Even post-Bake Off and her book deal (she works full-time as an accountant), Dossou remains a savvy shopper, knowing that a higher price doesn’t always mean a better product. “Like a bar of chocolate, if it’s the same quantity of cocoa, why are you paying three times the price? Especially if you’re going to bake with it. “Wonky onions at half the price is the same… they all come from the same farm.” Her accountancy skills came in handy, too, and she still uses a spreadsheet to track her income and outgoings every month. “I think generally in life it is important to budget and know where your money goes, because I think it allows you to achieve a lot more than if you were just living freestyle,” Dossou says. “It’s a nightmare trying to get on the housing ladder here in the UK – that’s something I’ve been able to do through being thrifty in every area of my life.” That’s why she decided to call her first cookbook The Thrifty Baker: “I just really wanted to bring that awareness of how we choose what we eat, and how we can save through making little changes here and there.” “Now, more than ever, when people are struggling with the cost of living, I think it’s even more important to go back to those values of cooking from scratch, trying to cook at home, and making meals from, you know, not much.” With lots of advice for beginners, the book focuses on affordable dishes, from basic breads and simple biscuits to special occasion puds and impressive-looking desserts. There’s a distinct Gallic influence (Benin, where Dossou learned to bake as a child, is a former French colony) felt with recipes such as pain de campagne, orange and brown butter madeleinesm and pear frangipane tart. The author points out when a recipe can be cooked in an air fryer – a recent Black Friday bargain she loves because it allows her to enjoy fried Benin delicacies using less oil and without turning on the oven. “Because we have a really small family, just me and my son, you don’t always want to put the oven on just to bake something for two. “With an oven you’ll need to preheat it for a good 15 to 20 minutes before you can even bake in it. With the air fryer you just put the cake in and 15 minutes later it’s out – easy and convenient.” There’s also a section devoted to microwaveable mug cakes, with peanut butter and jam, speculoos (aka Biscoff) and chocolate hazelnut flavours of the cheap and easy-to-make single-serve puds. “In the microwave you can make a cake in five minutes from weighing, mixing and baking,” says Dossou, who loves how kid-friendly they are. “With my son I feel more inclined to let him make a mug cake than maybe something bigger. “Even if it goes wrong he’s not wasting a lot of ingredients and, you know, he’s not turning the kitchen into a bonfire.” ‘The Thrifty Baker’ by Hermine Dossou (White Lion, £18.99).

2023-09-06 13:58