Less than half of children ‘have received a meaningful financial education’

Less than half (47%) of children and teenagers aged seven to 17 have received a meaningful financial education, according to a Government-backed body. The Money and Pensions Service (MaPS) estimates from its findings that around 5.4 million children across the UK do not have the money skills they will need in adulthood. Children living in social housing, rural areas and in lower income households were found to be less likely to have received a meaningful financial education. And children with parents or carers with mental health conditions tend to be less likely to have received a meaningful financial education than the UK average, the findings indicate. The measure of meaningful financial education is based on the percentages of young people who recall receiving financial education at school that they considered useful, and/or received regular money from parents or work, with parents setting rules about money and handing over responsibility for some spending decisions. Research was conducted for MaPS between late summer and autumn 2022 across the UK by Critical Research, among more than 4,700 children and young people aged seven to 17 and their parents or carers. The proportion of children and teenagers found to have received a meaningful financial education is similar to 2019, when the figure was 48%. The report said: “When interpreting these results, it is worth remembering the disruption to education and normal life caused by the Covid-19 pandemic potentially limited opportunities for children to receive a meaningful financial education at school and/or home over the last three years. According to the latest findings, a third (33%) of children recall learning about money in school and finding it useful, and nearly a quarter (24%) have received key elements of financial education at home. It is worth remembering the disruption to education and normal life caused by the Covid-19 pandemic Money and Pensions Service report Only 10% reported having both, suggesting that children and young people tend to receive meaningful financial education either at home or at school and not as “joined-up” financial education, the report said. Younger children aged seven to 11 continue to be less likely to have received a meaningful financial education than older children aged 16 to 17, according to the report. Children in Scotland are the most likely (52%) to have received a meaningful financial education, the report indicated, followed by those in Wales (51%), England (46%) and Northern Ireland (43%). Those in Wales (79%) are more likely than those living in the UK (71%)as a whole to receive regular money from parents/carers or work, according to the research. As part of its UK strategy for financial wellbeing, released in 2020, MaPS is aiming for two million more children aged five to 17 to receive a meaningful financial education by 2030. It is urging parents to talk to their children about money and combine it with everyday experiences, such as food shopping, budgeting and wages from a part-time job. Our experiences in childhood prepare us for adulthood and learning about money is no different Sarah Porretta, Money and Pensions Service To help with this, MaPS offers free resources such as “talk learn do“, an online tool that helps parents to start the conversation. The MaPS, which is sponsored by the Department for Work and Pensions (DWP) and funded by levies on the financial services industry and pension schemes, added that teachers, school leaders and governors should work together to deliver financial education in classrooms. It is also calling on financial services and funders such as charitable trusts to increase their investment in the delivery of financial education. Sarah Porretta, executive director at MaPS said: “These figures will alarm everyone in financial education because more than five million children could be going without. “Our experiences in childhood prepare us for adulthood and learning about money is no different. It becomes a part of daily life and our financial decisions can bring real benefits and profound consequences, so it’s crucial to learn from a young age. “The race is on to educate the nation’s children and everyone, from banks and building societies to foundations and financial institutions, has a big part to play. “Parents and schools can also make a huge difference by combining money skills with everyday experiences, both inside and outside the classroom.” Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Harry Potter star Miriam Margolyes makes British Vogue cover debut aged 82 Toff: Drinking mindfully is a gift to yourself Should you sleep naked? Heatwave myths debunked

2023-06-14 17:52

Cathay Pacific Offers to Redeploy Spare Pilots to Low-Cost Unit

Continuing to untangle itself from the legacy of Covid, Cathay Pacific Airways Ltd. offered its junior pilots the

2023-06-14 16:26

Federal assistance sought for northeastern vineyards, orchards hit by late frost

Vineyards and apple orchards across the Northeast are still gauging damage from a late-season frost in May that wiped out a third to most of the crop for some growers who say it's the worst frost damage they've ever seen

2023-06-14 13:23

As conditions for Syrians worsen, aid organizations struggle to catch the world's attention again

Aid agencies will struggle to draw the world’s attention back to Syria at an annual donor conference hosted by the European Union in Brussels for humanitarian aid to Syrians

2023-06-14 13:19

Europe’s New Favorite Beach Hotspot Needs Workers to Meet Demand

Croatia’s entry into the euro and the European Union’s free travel area are working out well for the

2023-06-14 12:46

How to Combine PDF Files

Knowing how to combine multiple PDFs into a single file is easy and can make

2023-06-14 05:23

The Best Productivity Apps for 2023

Talking about personal productivity has never felt as tasteless as it does now. After many

2023-06-14 03:27

TikToker cooks rack of ribs in hotel bathroom using only items from his room

A TikTok influencer managed to cook a rack of baby back ribs in his hotel bathroom using only items found in his room. User @barfly7777 showed off the ingredients he bought - including char siu rub - before getting to work. He was seen putting the ribs in his makeshift oven - a pillow case - before heating it with a hairdryer. After tying the pillowcase closed, the “chef” suggests roasting the ribs for four hours, before adding honey glaze and cooking for a further three hours. He then shows off the finished meal - complete with corn and a jacket potato - after checking the temperature of the meat. Read More Schoolboy almost dies from swallowing magnets for TikTok challenge Woman shares honest review of New York City apartment TikTok mom slammed after making 5-year-old son run in 104 degree heat

2023-06-14 03:19

Accenture pouring $3 billion into AI, joining long list of tech companies prepping to meet demand

Technology services provider Accenture is the latest company to ramp up its artificial intelligence business, announcing Tuesday that it will invest $3 billion over the next three years and double its AI-related staff to accommodate scorching hot demand

2023-06-14 02:17

Rash Judgment: A 68-Foot-Long Poison Ivy Vine is a Guinness World Record Holder

The finding was confirmed when the property owner broke out in a rash.

2023-06-14 01:28

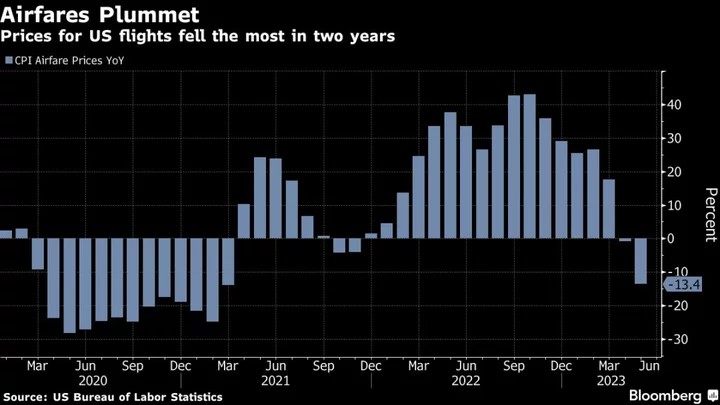

Travelers Catch Break as US Airfares, Rental Car Prices Fall

Restless Americans fueling white-hot demand for travel caught a break last month thanks to lower prices for airline

2023-06-14 00:46

Earning Money on YouTube Just Got Easier

YouTube is lowering its entry requirements for joining the YouTube Partner Program (YPP), which unlocks

2023-06-14 00:25