BOE Chief Economist Warns Gas or Food Prices Could Trigger Rate Move

Bank of England Chief Economist Huw Pill warned that a surge in food or natural gas prices could

2023-08-04 21:16

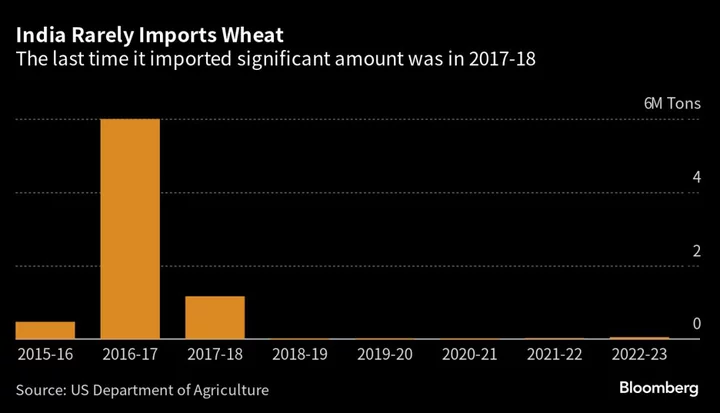

India Weighs Scrapping Duty on Wheat Imports to Control Prices

India, the world’s second-biggest wheat producer, is considering abolishing an import tax to make buying the grain from

2023-08-04 20:58

Italy’s Meloni Wants to Help Tourists Struggling to Hail a Taxi

Before Prime Minister Giorgia Meloni goes on her summer break, she aims to resolve an issue which is

2023-08-04 18:54

British Airways Staff Win 13% Pay Rise, £1,000 One-Off Payment

Around 24,000 British Airways employees will get a pay rise of 13.1% over an 18-month period as demand

2023-08-04 17:56

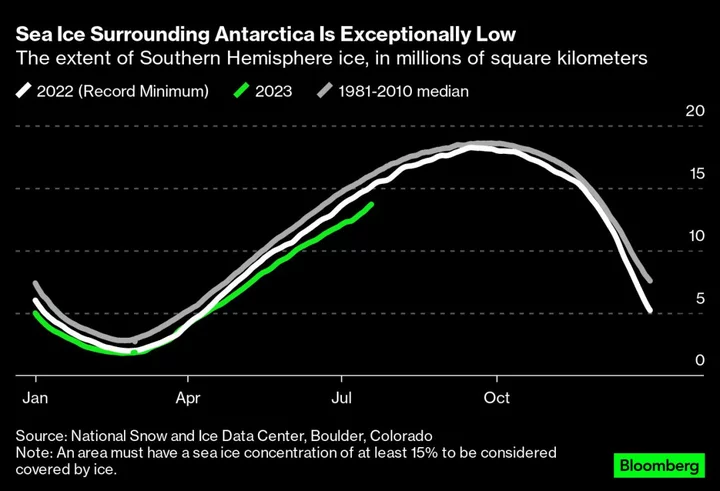

Sailors Are Collecting Climate Data as They Race Around the World

Round-the-world sailors can sense something is different. Steeper waves? Shifting winds? There’s no missing the calls to change

2023-08-04 17:55

The devastating mental health impact of soaring mortgage costs

Almost a third of people in England and Wales said their mental health has been affected by soaring mortgage costs in the past year, according to new research. For people with existing mental health problems, nearly four in 10 said the rising costs had worsened their mental health. Mind, the UK’s biggest mental health charity, also said it had seen a 55 per cent increase in the number of people contacting its Infoline over the last 18 months about financial difficulties, including welfare, unemployment and personal debt. The charity’s survey of 3,015 respondents across England and Wales in March and April came before Thursday’s news that the Bank of England had raised interest rates to 5.25 per cent from 5 per cent. The hike, which is yet another bid to get inflation under control, will put more pressure on mortgage holders. Mind’s survey – carried out by Censuswide – suggested that 29 per cent of people had been affected by hearing about or experiencing increasing mortgage costs over the last year. Ten per cent said that it had affected their mental health a lot, the charity added. For people with existing mental health problems, some 36% said the increasing mortgage costs had made their mental health worse. The charity said younger people were particularly affected, with almost half (48%) of those aged between 16 and 24 saying that the mortgage situation had impacted on their mental health. Vicki Nash, Mind’s associate director of external affairs, said financial difficulties and mental health problems “often form a vicious cycle”. She said: “As we continue to grapple with the rising cost of living, news of yet another possible increase in mortgage rates will be difficult for many families to bear. “Money problems and mental health often form a vicious cycle, and when we’re struggling to deal with one, the other can become much harder to manage, particularly when it threatens to impact our housing situation. “We know some people are becoming so unwell that they need hospital treatment for their mental health. “When this happens the care they receive when they leave hospital is critical so we are calling for the introduction of comprehensive welfare checks, including of people’s financial situation. “These figures show this is a mental health emergency that everyone is going to need help to deal with. We know we can’t fix the cost-of-living crisis but support for your mental health is out there, and we are here for you. “This includes through Mind’s Infoline, online community, Side by Side and the useful information on our website that will be available throughout this difficult period.” Mind has a confidential information and support line which can be called on 0300 123 3393 between 9am and 6pm from Monday to Friday, or people can visit mind.org.uk. Read More ‘Unsackable’ Jeremy Hunt to remain chancellor as Rishi Sunak eyes ‘election-ready’ Cabinet reshuffle Lizzo: All the allegations made by former dancers – from sexual harassment to body shaming The Bank hikes interest rates again – but the end of the pain could finally be in sight Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live

2023-08-04 17:48

Soaring mortgage costs ‘affecting mental health of almost a third of people’

Almost a third of people in England and Wales said their mental health has been affected by soaring mortgage costs in the past year, according to new research. For people with existing mental health problems, nearly four in 10 said the rising costs had worsened their mental health. Mind, the UK’s biggest mental health charity, also said it had seen a 55% increase in the number of people contacting its Infoline over the last 18 months about financial difficulties, including welfare, unemployment and personal debt. The charity’s survey of 3,015 respondents across England and Wales in March and April came before Thursday’s news that the Bank of England had raised interest rates to 5.25% from 5%. The hike, which is yet another bid to get inflation under control, will put more pressure on mortgage holders. Mind’s survey – carried out by Censuswide – suggested that 29% of people had been affected by hearing about or experiencing increasing mortgage costs over the last year. Ten per cent said that it had affected their mental health a lot, the charity added. For people with existing mental health problems, some 36% said the increasing mortgage costs had made their mental health worse. Money problems and mental health often form a vicious cycle, and when we’re struggling to deal with one, the other can become much harder to manage, particularly when it threatens to impact our housing situation Vicki Nash, Mind The charity said younger people were particularly affected, with almost half (48%) of those aged between 16 and 24 saying that the mortgage situation had impacted on their mental health. Vicki Nash, Mind’s associate director of external affairs, said financial difficulties and mental health problems “often form a vicious cycle”. She said: “As we continue to grapple with the rising cost of living, news of yet another possible increase in mortgage rates will be difficult for many families to bear. “Money problems and mental health often form a vicious cycle, and when we’re struggling to deal with one, the other can become much harder to manage, particularly when it threatens to impact our housing situation. “We know some people are becoming so unwell that they need hospital treatment for their mental health. “When this happens the care they receive when they leave hospital is critical so we are calling for the introduction of comprehensive welfare checks, including of people’s financial situation. “These figures show this is a mental health emergency that everyone is going to need help to deal with. We know we can’t fix the cost-of-living crisis but support for your mental health is out there, and we are here for you. “This includes through Mind’s Infoline, online community, Side by Side and the useful information on our website that will be available throughout this difficult period.” Mind has a confidential information and support line which can be called on 0300 123 3393 between 9am and 6pm from Monday to Friday, or people can visit mind.org.uk. Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Consuming foods with added sugars may increase risk of kidney stones – study Why TikTok is going wild for lip oil 5 late summer blooms to plant now

2023-08-04 17:27

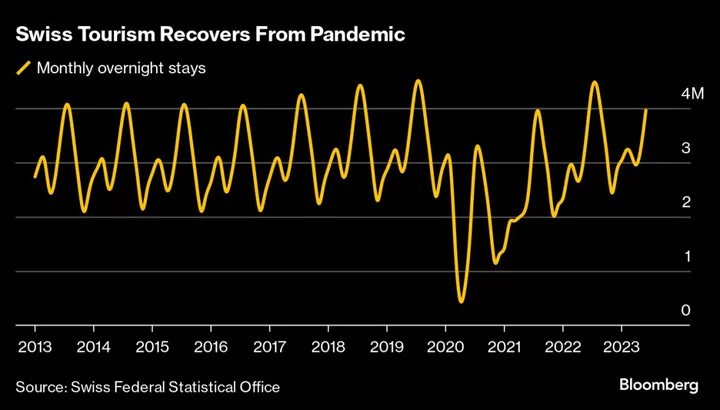

Swiss Hotels See Demand Jump as Tourists Brush Off Soaring Franc

International visitors flocked to Switzerland in the first half of the year, driven by a doubling in demand

2023-08-04 17:25

World food price index rebounds in July as vegetable oils rise

PARIS The United Nations food agency's world price index rebounded in July from two-year lows as vegetable oil

2023-08-04 16:55

Israeli Startup Applies to Put Lab-Grown Steaks on British Menus

Cultivated meat startup Aleph Farms Ltd. is seeking regulatory approval to sell its beefsteak in the UK, as

2023-08-04 16:48

Consuming foods with added sugars may increase risk of kidney stones – study

Consuming foods with added sugars – such as soft drinks, ice-cream and cakes – may increase the risk of developing kidney stones, according to scientists. Researchers have found that those in the US with the highest intake of added sugars had nearly 40% greater odds of developing kidney stones. They said this association was more prevalent among Asians as well as Native Americans. But the researchers pointed out that their study, published in the journal Frontiers, does not show how exactly added sugars increases the risk of kidney stones. Lead author Dr Shan Yin, a researcher at the Affiliated Hospital of North Sichuan Medical College, Nanchong, China, said: “Ours is the first study to report an association between added sugar consumption and kidney stones. “It suggests that limiting added sugar intake may help to prevent the formation of kidney stones.” One in 11 people will get stone symptoms during their lifetime, according to The British Association of Urological Surgeons. Ours is the first study to report an association between added sugar consumption and kidney stones. Dr Shan Yin Known risk factors include obesity, inflammatory bowel disease, diabetes, and being an adult male. For the study, the Dr Yin and colleagues analysed data from more than 28,000 people who were part of the US National Health and Nutrition Examination Survey (NHANES) survey. Each person’s daily intake of added sugars was estimated from their self reported food and drink consumption. They also received a healthy eating index score (HEI-2015), based on the food they ate, whether it was beneficial foods such as fruits, vegetables, and whole grains, or less healthy options such as refined grains or saturated fat. The researchers adjusted for factors such as gender, age, race or ethnicity, income, body mass index, HEI-2015 score, smoking status, and whether the people taking part in the study had a history of diabetes. The researchers said people who received more than 25% of their total energy from added sugars had a 88% greater odds than those who had less than 5% of their total energy from added sugars. Results also showed people below poverty levels had greater odds of developing kidney stones when exposed to more added sugars than those at or slightly above poverty levels. Dr Yin said: “Further studies are needed to explore the association between added sugar and various diseases or pathological conditions in detail. “For example, what types of kidney stones are most associated with added sugar intake? “How much should we reduce our consumption of added sugars to lower the risk of kidney stone formation? “Nevertheless, our findings already offer valuable insights for decision-makers.” Read More Charity boss speaks out over ‘traumatic’ encounter with royal aide Ukraine war’s heaviest fight rages in east - follow live Why TikTok is going wild for lip oil 5 late summer blooms to plant now Why have the birds disappeared from my garden?

2023-08-04 15:57

China to lift tariffs on Australian barley as trade ties improve

By Dominique Patton and Lewis Jackson BEIJING/SYDNEY China's Ministry of Commerce said on Friday it would drop anti-dumping

2023-08-04 15:19