Roughly two months after Bud Light endured a self-induced injury that torpedoed sales, the brand continues to lose ground to its competition. But there are signs the worst might be over.

Sales for the week leading into Memorial Day weekend fell 23.9% from the same period a year ago. That constitutes a slight improvement compared to the week prior when sales were 25.7% lower than a year earlier. That could indicate that the "bottom has been hit and we are seeing a turn-around in performance," according to Bump Williams, an alcohol industry expert.

For the past several weeks, Bud Light sales declines have hovered around 25% weekly because of customer revolt following an Instagram partnership with transgender influencer Dylan Mulvaney. A single can bearing her face was given to her for a post, but some right-wing media attacked the brand, and some social media posts spewed transphobic comments.

Anheuser-Busch's tepid statement about the controversy also angered some LGBTQ+ groups.

In response, Anheuser-Busch said it was bolstering marketing on Bud Light and would offer rebates to customers. Last weekend, the company offered $15 back on 15-packs of beer leading to cases be priced as low as $1.50 in some states, which Williams said contributed to part of its minor turnaround.

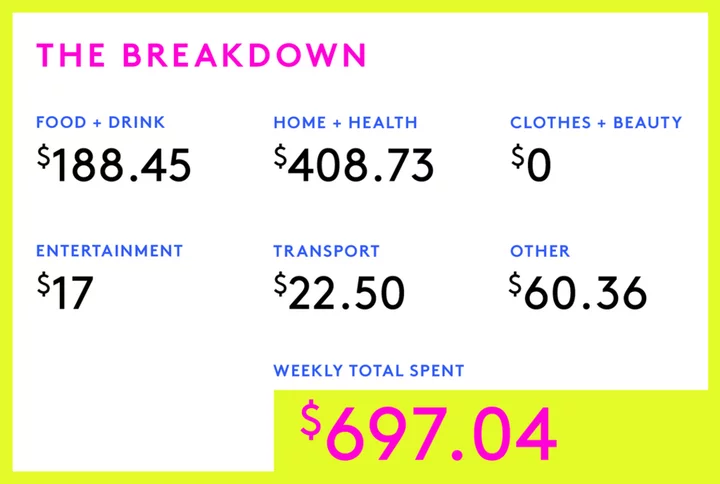

Still, Bud Light remains the top selling beer in America, according to NIQ data provided to CNN by Williams. NIQ measures sales at convenience, liquor and grocery stores across the United States. Bud Light has made up 35.1% of domestic beer sales this year (through May 27), according to NIQ. That easily beats No. 2 Coors Light, which controls 21.6% of the market.

Although Bud Light's share of the domestic beer market has slipped considerably over the past couple months, it remains in the lead. In the week that ended on May 27, Bud Light controlled 28.8% of the market, compared to Coors Light, which made up 25.6% of overall sales, NIQ reported.

The biggest beneficiaries of Bud Light's slipping sales continue to be MolsonCoors' Miller Light and Coors Light, with sales up a whopping 26% and 23% respectively, according to NIQ. Beer Business Daily reported Monday that some distributors are reporting shortages but a company spokesperson told CNN that its supply is strong for the summer.

Another bright spot is for Modelo, which distributed by Constellation Brands. Sales of its Modelo Especial and its recently launched low-carb beer Modelo Oro are strong with sales up 9.5% and its share of the total beer category surpassing Bud Light last week, Williams said. He added that it's "not a surprise" because of a halo effect from Cinco de Mayo and heavy advertising supporting its Oro launch.