Japanese policymakers and business leaders appear far more sanguine about the recent slide in the yen than they were about last year’s intervention-triggering collapse — a sign they see the weakness as temporary.

While the currency is at an almost eight-month low against the dollar and at its weakest against the euro in 15 years, the panic of 2022 doesn’t appear to be coursing through the veins of officials, consumers and company executives yet. Last year, Japan spent $65 billion on direct purchases of the yen to help drag it off a three-decade low versus the greenback.

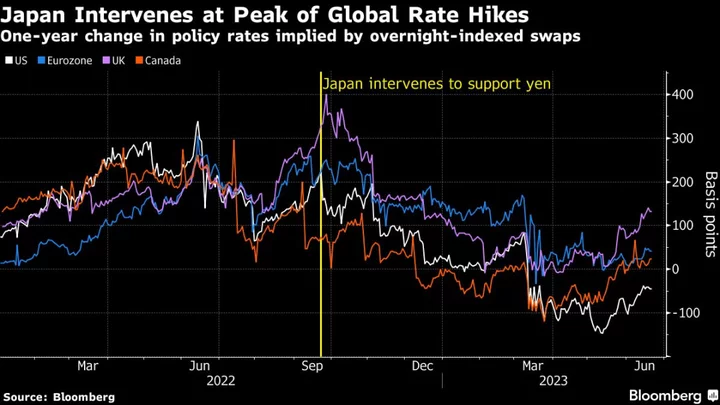

One key factor is the perception central banks are nearer the end of the global rate hike cycle than the beginning. While it’s still not clear when those like the Federal Reserve will reach stop, that view has helped dampen fears that Japan is peering into the abyss of a yen freefall.

And an extended period of modest currency weakness could counterintuitively lay the ground for long-run yen strength should it help the Bank of Japan boost growth, attain its inflation goal and finally embark on a pivot from the past decade of super-easy monetary policy.

The bottom-line boost to exporters from the soft yen and renewed optimism over the economy have already helped the stock market chalk up 33-year highs.

“Pressure on the yen won’t escalate much from here. The Fed is approaching its terminal rate with probably one more hike, at most two,” said Atsushi Takeda, chief economist at Itochu Research Institute. “The yen doesn’t have the same falling momentum like last year.”

Yen Backdrop

The stark contrast between Japan and its ultra-low interest rates aimed at stoking prices and the robust rate hikes of the US intended to cool them has provided the key backdrop for yen weakness since the Fed began its tightening campaign early last year. The Asian nation’s widening trade deficit as commodity prices climbed only added fuel to that fire.

The occasional brakes to that trend have been recession fears, banking sector turmoil and the realization that Tokyo will act to defend its currency, even if it means irritating its allies in Washington.

Japan has a long-stated focus on the pace of declines rather than any particular target. When officials stepped into markets as the currency approached 146 in September and 152 in October, on each occasion the dollar had moved by more than 2 yen in less than 24 hours. Volatility is at much lower levels this year.

“Although the yen has weakened, the issue here is the speed of moves and pace of inflation,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management Co. “The authorities are unlikely to take action at this moment.”

But while the yen at 144 per dollar now seems a lot less scary than it did a year ago, a further fall toward the 150s would still likely jolt Japan out of its new comfort zone and on the road to fresh action.

Those levels would also be a bad place for Prime Minister Fumio Kishida to consider holding an early election later this year, as it would likely reignite voter discontent over the rising cost of living.

A decision by the US Treasury in mid-June to drop Japan from its currency watchlist appears to give a tacit green light to more yen buying by Tokyo should sharp moves justify it.

“They are only going to step in if the yen is about to break through 150,” said Hideo Kumano, executive economist at Dai-Ichi Life Research Institute. “Although they did it last year, currency intervention is still the last option.”

Yen Beneficiaries

For now policymakers are feeling less heat from the public and corporate realms. While the plunging yen last year may have forced some companies to tear up their hedging strategies, the current range is familiar territory.

Japanese firms with a global presence have long been the biggest beneficiaries of a cheap yen — a factor that inflates their overseas earnings. A softer currency added 1.3 trillion yen ($9.1 billion) to Toyota’s annual operating profits and magnified the sales of five key segments at Sony by about 1.2 trillion yen.

On the flipside, importers like Tokyo Gas feel the pain. Its operating profit fell 9.5 billion yen due to the weaker currency in the latest fiscal year.

The difference this year is that globally focused companies benefiting from the soft yen are now joined by a domestic travel industry reveling in the return of foreign tourists after the lifting of pandemic restrictions.

First quarter spending by overseas visitors in Japan was around 88% what it was in 2019, with the biggest spenders coming from South Korea, Taiwan and Hong Kong. That helped lift economic growth by an annualized 1.1 percentage point in the first three months of the year.

“Unlike last year, the yen is now providing benefits to regional economies through a surge in foreign tourists,” said Itochu’s Takeda. “That’s one of the key reasons that criticism hasn’t penetrated across the nation in the same way, providing the authorities with more time to monitor the situation.”

What Bloomberg Economics Says...

“Businesses and consumers are more tolerant of the weak yen now than they were last year...the recent rally in Japanese stocks may also be helping their mood. Still, things will get political if the dollar-yen rate drops back into the upper 140-yen range.”

— Taro Kimura, economist

Gordian Knot

Still, if market players do want to test the bounds of Tokyo’s patience, that would put Kishida in an awkward spot.

The central bank is continuing all-out stimulus to fire up sustainable inflation while the government is forking out trillions of yen to limit price growth by subsidizing electricity bills and keeping a lid on costs at the gasoline stand.

Government intervention in currency markets seems a less obvious solution to a weak yen than having the central bank pull back from stimulus instead. But new BOJ Governor Kazuo Ueda is proving far more dovish than expected.

Inflation continues to outpace expectations and the BOJ is likely to raise its quarterly price forecast in July. Such a revision could be used to justify a tweak to yield-curve control, a move that would likely enable long-term rates to roam upward.

That would almost certainly give the yen a helpful lift without having to dig into the nation’s foreign exchange reserves again, while leaving markets time to calm down before an early election that could come as soon as the autumn. Most economists don’t expect change for some time to come, though it’s not a consensus view.

Ueda has said the sustainable inflation he seeks still isn’t in sight and that easing should continue, but he hasn’t totally ruled out a surprise move.

“In between one policy meeting and another, various new data come in. Based on that information, the latest policy meeting may have a different result to the one before,” Ueda said after the BOJ’s June decision. “It’s inevitable that sometimes there’s a certain element of surprise.”

Cycle Finale

Even without a move by the central bank to normalize its policy, analysts see the yen regaining some strength as the finale of the global tightening cycle plays out. Expected rate increases by major central banks over the next 12 months are well below levels seen during intervention last year.

“It will probably be clearer in September when the Fed will stop tightening and there may be some signs from the ECB too,” said Koji Fukaya, a fellow at Market Risk Advisory. “That means the yen may strengthen toward 130 before year-end and then 125 next year.”

--With assistance from Paul Jackson and Takashi Mochizuki.