The threat of Russian aggression towards Ukraine’s Black Sea ports and ships will force the country to export its enormous quantities of grain by river, road and rail — all of which are fraught with challenges.

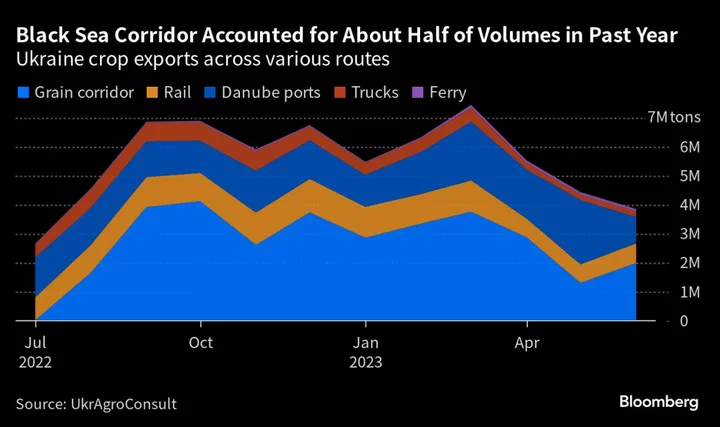

After exiting the Black Sea grain export deal earlier this week, Russia announced that all ships headed to Ukrainian ports will now be considered military vessels. With harvests coming in, that means Ukrainian farmers will no longer be able to rely on the route that was used to move about half of last season’s crops.

That adds to pressure on global food markets, and delivers a serious blow to one of Ukraine’s biggest sources of revenue.

The Black Sea historically ushered the vast majority of Ukraine’s grain exports abroad and helped the country become one of the world’s top suppliers. Cutting off the ports will reduce Ukraine’s monthly export capacity from about 7-8 million tons to a maximum of about 4 million tons, estimated Alexandre Marie, chief analyst at Agritel, the agriculture analytics arm of Argus Media.

It also adds to a host of logistical problems. The news has stoked renewed fears of global food inflation and will put additional financial pressure on Ukrainian farmers. It forces the country to double-down on lengthier and costlier routes to global markets — the most obvious being the Danube. But a heatwave fanning across the southern part of Europe is lowering river levels and crimping export capacity, which will make shipping grain even more difficult.

Overland routes are also challenged by the fact that Eastern European nations are continuing to push back against crop inflows from Ukraine on behalf of local farmers who have protested that the imports pose a threat to their livelihood.

Of these options, Danube River ports in particular “are going to be extensively relied on,” Michael Magdovitz, senior analyst at Rabobank, said by phone. The volume of crops transported along the river has climbed from about 1.4 million tons to 2 million tons per month in the past year. In May and June, those shipments even overtook the Black Sea corridor, where inspections slowed the flow of ships.

From the Danube, grain can either be transported directly to nearby buyers or shipped to hubs like Constanta in Romania, where it is loaded onto bigger ships for longer journeys. One difficulty, however, is that because larger vessels can’t travel on the river, “you’re going to be squeezing logistics through this very small channel,” said Magdovitz.

The heatwave gripping southern Europe is compounding the issue.

In Romania, the Danube is nearly 40% lower than the average level in July because of high temperatures, according to Romania’s water management institution. It remains well above the two-decade low reached last year, but could decline further next week.

“The problem is also that the water level in the Danube is getting lower day by day due to drought, so you can’t load barges with wheat at full capacity,” Constanta-based grain broker Andrei Balasoiu said.

Rail and road routes will also be key. Although Eastern European nations are continuing to push back against the purchase of Ukrainian grain, the countries are still allowing crops to transit through their borders to make deliveries. Even so, the volume of grain transported by rail and road has fallen since March, when political tensions began to heat up.

Traders have already been using the alternative routes. The question now is how long they will be the only option and whether a new Black Sea deal can be arranged, said Sergey Feofilov, head of analysis company UkrAgroConsult.

Russia has said that it would be willing to return to the deal if its conditions are met. It has for months demanded that one of its agricultural banks be reconnected to the SWIFT international payments system, and has made additional demands on logistics and insurance. Russian banks were cut off from SWIFT after the full-scale invasion of Ukraine.

This week’s Black sea shipping threats are “taking us further away” from efforts to reopen the corridor, Stephane Dujarric, spokesman for the United Nations secretary-general, said at a Thursday press briefing.

Ukraine has said it plans to boost export capacity via alternative routes, although that could take time. The country’s infrastructure minister has estimated that the Danube alone could handle 23 million to 25 million tons of foodstuff exports this year, about half of the country’s annual prewar grain export. USAID has also pledged to help boost capacity.

While the river and roads were already an economic lifeline, they will now have a bigger influence over global grain supply and will be key to helping reduce rising food costs. The routes “probably won’t be enough, but will cover a big chunk of the need,” said Roman Slaston, head of the Ukrainian Agribusiness Club.

--With assistance from Andra Timu, Jasmine Ng and Irina Vilcu.

(Updates with UN comment in 15th paragrah.)

Author: Megan Durisin and Áine Quinn