Thailand risks missing its growth targets without the injection of a large dose of cash into the economy, Prime Minister Srettha Thavisin’s top aide said, amid mounting backlash against the government’s plan for a $14 billion handout next year.

All the high-frequency economic indicators including private consumption, factory utilization and investments point to a steady downtrend, signaling that meeting the finance ministry’s growth targets of 2.7% this year and 3.2% in 2024 remain challenging, according to Srettha’s Secretary-General Prommin Lertsuridej.

“This time we have to inject a big lump of money and use it fast,” Prommin, a key strategist of the Pheu Thai ruling party, said in an interview on Thursday. “The way we will use it may be like the helicopter money. Ten thousand baht for each individual is quite a big amount and we hope to lift the growth up with this payout.”

Thailand’s household debt has soared to almost 92% from 76% a decade ago, factory output has shrunk for a 12 months in a row and private consumption, a key driver of the economy, contracted in September after expanding 6.3% in 2022. A slew of other data also signaled that the economy is in a crisis and needs an urgent intervention to prevent it further from weakening, Prommin said.

The centerpiece of Srettha government’s strategy to lift the economy out of the cycle of low growth is a so-called digital wallet program that will see 50 million Thais 16 years old and above receiving a one-time handout of 10,000 baht ($284) in May 2024. The government plans to borrow the money for the project by passing a special bill in the parliament, a move slammed by the main opposition party and some economists as it may widen the nation’s fiscal deficit and stoke inflation.

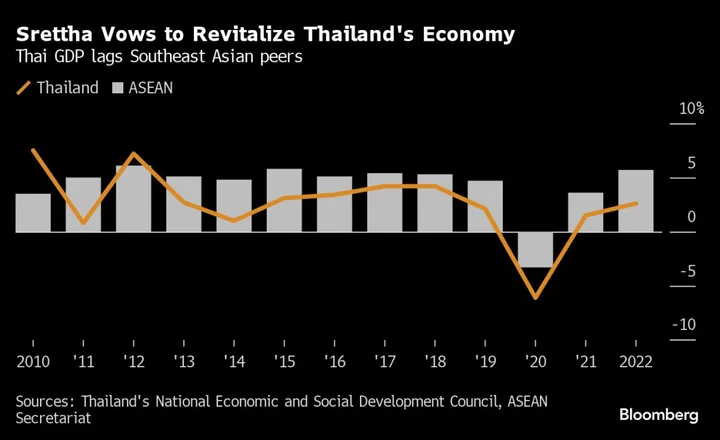

The government was duty-bound to do everything it can to lift growth from an average 1.9% in the past decade that saw the military or parties backed by it rule the country, said Prommin.

Southeast Asia’s second-largest economy has lagged the growth of many of its neighbors in recent years. Srettha has argued it was important to lift the annual gross domestic product expansion to 5% to attract foreign investment and help people repay their debt.

Economists expect the country’s GDP to have increased by 2.1% in July to September in a Bloomberg survey ahead of the Nov. 20 data release.

‘Whipping a Donkey’

The cash handout plan has been criticized by some former central bankers and the Bank of Thailand Governor Sethaput Suthiwartnarueput, who said it was “inappropriate” while calling for steps to boost investment.

The main opposition party, Move Forward, on Thursday said there were no easy quick fixes for the economy whose highest growth potential is seen as 3%. Setting a 5% growth target is like “whipping a donkey to run as fast as a horse,” party’s deputy leader Sirikanya Tansakun said.

The BOT sees the economic growth gaining momentum next year with a recovery in tourism. But the central bank move to lift its key interest rate to a decade high 2.5% was adding to the crisis and people’s suffering as BOT was focused on its mandate of inflation targeting and financial stability, Prommin said.

The government acknowledges the central bank’s autonomy in monetary policy matters guaranteed by a special law which also allows the governor to express his disagreements over fiscal policy, Prommin said.