Thailand plans to promote the use of yuan and other Asian currencies in trade and investments to curb wild swings in the baht against the US dollar, according to a central bank official.

The Bank of Thailand expects greater use of regional currencies to help reduce exchange risk as they often move in tandem with the baht, Assistant Governor Alisara Mahasandana said in an interview in Bangkok last week.

While Thai efforts to promote currencies other than the dollar are more than a decade old, they are gaining momentum now with a slew of bilateral central bank arrangements and development of financial infrastructure, she said.

Trade and tourism-reliant Thailand is among a number of nations taking steps to mitigate the risks of a still-strong dollar that’s weakened local currencies and become a tool of economic statecraft. BOT has been working with its counterparts from China, Malaysia and Indonesia to promote local currencies in their countries. More progress will be seen in the second half, Alisara said.

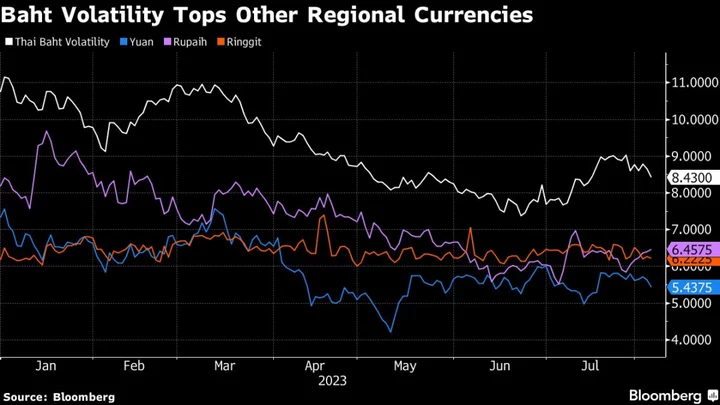

The baht rallied 3% in July — the most among major Asian currencies — after falling for three straight months. A gauge of expectations for price swings in the baht is near its highest level since May.

“The dollar-baht volatility has risen since last year, so it’s important to have more tools to cope with that,” said Alisara, who oversees financial markets operations group at the central bank.

Thailand’s central bank began a revamp of its foreign exchange rules in 2020 with the baht figuring in the US Treasury’s monitoring list for currency manipulation. But a rare current-account deficit during the pandemic — mostly due to vanishing of billions of dollars in tourism revenue — sent the baht tumbling to a 16-year low last year. It has since bounced back about 10%.

Thailand has been promoting the use of regional currencies since 2011, but the adoption has been slow because of hurdles ranging from rigid foreign exchange rules to lack of local currency liquidity, high hedging costs and a lack of awareness, according to BOT.

Yuan-denominated trade with China, Thailand’s largest trade and investment partner, increased to just 1.2% last year from about 0.3% of total trade in 2015. But greater yuan use is possible now with China recently relaxing rules and companies being more open to explore alternatives to reduce currency risks, Alisara said.

READ: China Takes Yuan Global to Repel Increasingly Weaponized Dollar

“It’s not easy to reduce the dollar’s usage as it’s the most liquid and the most widely-used currency,” Alisara said. “But it also doesn’t mean we should stop pursuing this program. At least we should offer them an alternative to help mitigate rising foreign exchange risk.”

BOT’s plans in the second half of this year to boost regional currency use include:

- Discussions with People’s Bank of China to ease foreign exchange rules and increase yuan liquidity

- Urging local banks to reduce the cost of yuan transactions

- To expand the scope of transactions for appointed cross-currency dealer scheme for rupiah and ringgit

- Increase the numbers of cross currency agents for rupiah and ringgit

- Holding awareness campaign for business operators on use of local currency in trade and investment

BOT’s foreign exchange reforms are meant to ensure an orderly movement in the baht, said Alisara, who will become a deputy governor for monetary stability from Oct. 1.

“We want the baht to move in line with market mechanism, in line with its fundamental,” Alisara said. “We may consider intervening in the currency only when the movements are excessive and against its fundamentals. The best way for businesses is to be prepared for the upcoming volatility.”