South Korea’s largest trip-booking company Yanolja Co. is acquiring Israeli technology provider Go Global Travel to become one of the world’s largest travel solution platforms.

Yanolja’s cloud business unit is buying the Israeli company from AMI Opportunities Fund, which is advised by Apax Partners, according to people familiar with the matter. Closely held Yanolja, which is set to keep the purchase price private, will gain access to GGT’s inventory of more than 1 million hotels and customers across North America and Europe, said the people, asking not to be named as the deal hasn’t been announced.

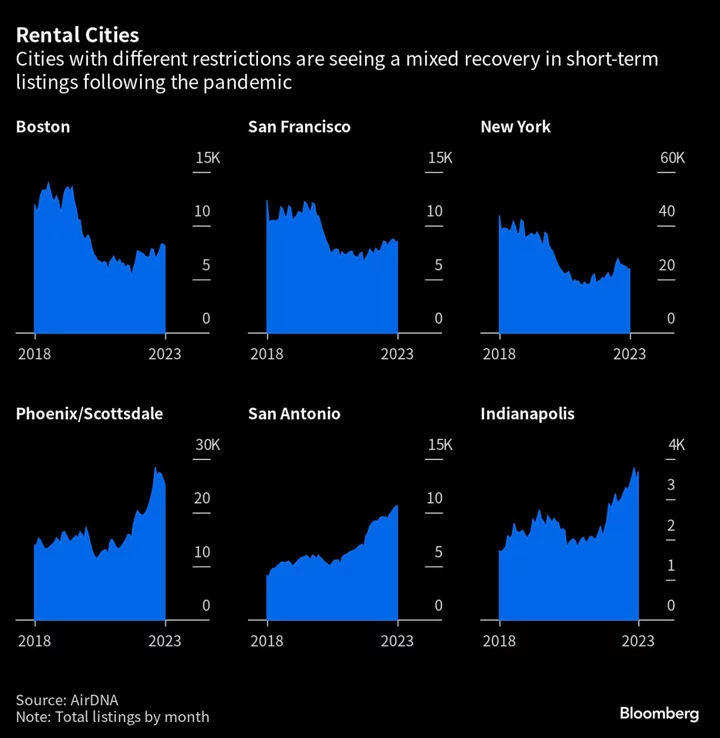

Backed by SoftBank Group Corp., Yanolja is expanding its cloud arm serving the hospitality and leisure industries to grow beyond consumer trip bookings. While the travel industry is recovering from a pandemic-era trough, competition from rivals such as Airbnb Inc. and Expedia Group Inc. is intensifying.

The Korean company, founded in 2005, is betting on growth in software services for customers such as hotels and hospitality providers. The global market for hotel property management systems is expected to grow more than 10% a year to about 1.8 trillion won ($1.4 billion) by 2027, according to a company filing.

In 2022, Yanolja’s total sales rose about 83% to 605 billion won. Its operating profit fell 90% to 6.1 billion won because of rising marketing expenses and costs to pay for its acquisition of concert and travel ticket provider Interpark.

Yanolja’s market value exceeded more than 10 trillion won in 2021 on a private company stock trading platform but has almost halved since as its markets slowed. Backed by SoftBank’s Vision Fund II, which holds about a 25% stake as of Dec. 31, and GIC Pte affiliate Apfin Investment, the Korean company has been mulling a stock-market listing in the US or at home.