Thai politicians are trying to outdo each other, promising voters billions of dollars worth of relief and freebies that offer near-term benefits and yet potentially damaging to the economy in the long run.

That’s prompted a word of caution from monetary managers, with Bank of Thailand Governor Sethaput Suthiwartnarueput discouraging political parties from pledging broad subsidies that can strain government funds. His worries were echoed by a colleague in the monetary policy committee.

“We should avoid policies promoting bad incentives,” said Somchai Jitsuchon, an economist at Thailand Development Research Institute and a member of BOT’s rate panel. An analysis by TDRI showed that about $92 billion a year is what’s required to implement the poll promises of nine political parties.

Many proposals are focused on farmers as they comprise the single-biggest voting group in the May 14 general election. Should the winner actually walk the talk on poll promises, it could end up pressuring already stretched public finances amid a fragile, post-pandemic recovery in Southeast Asia’s second-largest economy.

The more immediate outcome of the vote, however, is the risk of uncertainty, as underlined by a warning from Prime Minister Prayuth Chan-Ocha’s party that a win by the opposition could plunge the country into a “black hole of conflict.”

Still, here are the areas in the economy to watch out for after the election:

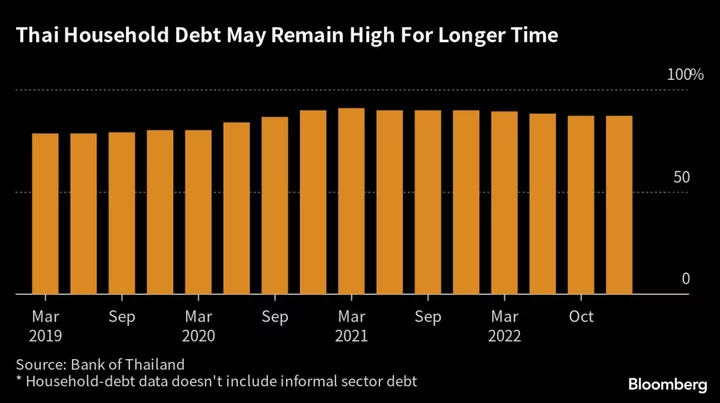

Household Debt

Thailand’s household debt that was already elevated before the pandemic climbed to 90% of gross domestic product in 2021. It’s closely-monitored by the central bank even as it’s eased slightly to 86.9% at end-2022.

A number of populist policies in the past led to rising household debt as the government used them as easy solution to stimulate the economy. Yingluck — the youngest sister of ousted premier Thaksin Shinawatra and who herself had to flee after a 2014 coup — offered a steep tax rebate in 2011 to 2012 to first time car buyers to boost demand after the nation’s biggest flood.

Household debt jumped to 71.8% of GDP by the end of 2012 from 60.3% at the start of 2011. The government also lost an estimated 91 billion baht ($2.7 billion) from that program.

Fiscal Gap

Thailand continues to lean on subsidies to stoke economic engines and shield citizens from rising cost of living, especially after inflation climbed to a 14-year high last year. Existing income guarantee and farm subsidies are estimated by the central bank to cost about 150 billion baht yearly.

As Thailand is a net oil importer, energy cost is another area where the government often gives support. The administration of Prayuth, who has ruled since the 2014 coup against Yingluck, had spent at least 200 billion baht to freeze diesel prices and subsidize cooking gas since early 2022.

“Stimulus policies giving this or that will help boost some numbers over the short term, but it will have long term effect such as higher debt,” Governor Sethaput said last month. “We have a limited budget, so we should use them efficiently in something that can create more long-term growth.”

The good news for now is that revenues have been robust and the government forecasts the budget deficit will narrow to 3% of GDP or lower in the fiscal year starting October from an estimated 3.7% in the current financial year. Thailand borrowed 1.5 trillion baht and lifted the public debt ceiling to 70% of GDP during the pandemic.

Low Growth

Thailand’s economic performance continued to languish last year as many of its neighbors returned to their pre-pandemic growth pace. The likes of Malaysia and the Philippines even posted decades-high GDP prints.

Thailand last saw above 5% annual economic growth in 2012, the term of Yingluck, when GDP grew 7.2%.

A clear mandate in this election, where results are accepted would support an economic recovery, according to a note by Goldman Sachs Group Inc. last month. Contested results that would spur protests may trigger another round of uncertainty that could delay investment and spending, Goldman Sachs said.

The baht hasn’t responded much to local political uncertainties, mainly following global financial markets. The local currency gained 2.7% year to date, the second-best performer among Asian currencies, tracked by Bloomberg after Indonesian rupiah.

On the other hand, the stock market is more responsive to political movements. The benchmark SET Index has slumped 6.1% in 2023, Asia’s worst-performing market this year. Thai investors are pinning their hopes on the election to revive stocks.

“Almost all parties’ policies will require rising spending, leading to big budget deficit over the next four years,” according to the Thai research institute that recently published a review of fiscal plans of leading opposition parties Pheu Thai and Move Forward as well as the military-linked Palang Pracharath and Bhumjaithai.

“This won’t only raise public debt, but also add risk to economic instability and accelerating demand-pull inflation,” the institute wrote, adding that uncontrollable inflation will create “serious damage” to the economy as it will trigger higher interest rates and further aggravate household debt.