Philippine President Ferdinand Marcos Jr. marks his first year in office with resilient growth and improving business sentiment as he rebalanced the country’s foreign policy and tapped credible economic managers.

As his administration enters its second year and faces prospects of softening demand amid elevated inflation, Marcos said delivering on his campaign promises to transform the economy is a work in progress.

“We have to bear in mind that the international situation has changed in terms of trade, in terms of geopolitics so we are having to adjust with that,” he told reporters Thursday. “The most successful economies are those that are agile and resilient and I think we have put in place the basic elements for us to do that.”

Marcos, who retains a high approval rating, must use his political capital to spur investment and create jobs, boost supplies and help cool prices and interest rates, said Fritz Ocampo, who helps manage about $34 billion as chief investment officer at BDO Unibank Inc., the country’s largest.

“All the doomsday scenarios didn’t happen,” Ocampo said of the skepticism that followed the landslide win of Marcos Jr, the 65-year-old son of the late Philippine dictator Ferdinand Sr. who ruled for two decades.

Here are key things to watch in the Philippines in the coming year:

Economic Growth

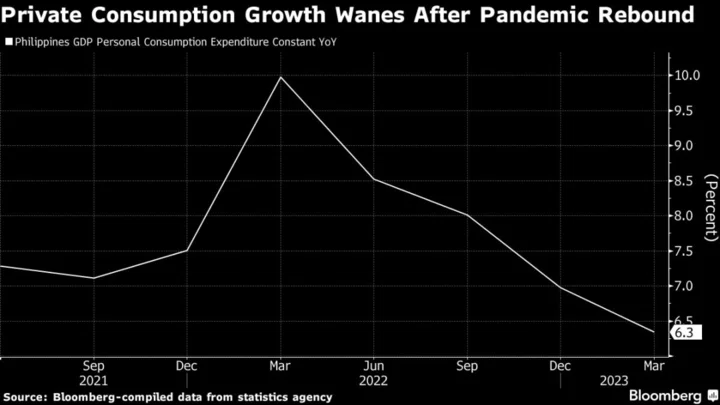

While the Philippines outperformed many of its neighbors last quarter, it remains to be seen whether it can sustain robust expansion amid a limping global economy. Consumption, which is a key growth driver, had moderated in the face of 16-year-high borrowing costs and lingering price pressures.

“We see that pent-up demand is waning, but this means that we are going to moderation that’s also good for inflation,” said Undersecretary Rosemarie Edillon of the economic planning agency.

Food Security

Marcos appointed himself as secretary of agriculture, aiming for self-sufficiency in food production like many of his predecessors. His single six-year term was greeted by shortages of food items like onions and sugar, helping stoke inflation to the fastest in 14 years at the start of 2023.

While supply issues have eased, threats to food security remain, including the potential impact of the El Nino weather pattern and African swine fever. Rice prices have been on an uptrend, putting into question Marcos’s campaign promise to bring down the costs of the staple grain.

For Ateneo de Manila University economics professor Leonardo Lanzona, the government needs to address logistical issues in agriculture and ensure reforms are benefiting farmers. “Certainly, we need somebody who knows more about the agriculture sector, particularly the problem of distribution.”

Fiscal Space

The Philippines’ fiscal space remains tight, even as the budget deficit has narrowed after hitting a record in 2021. As the government plans a 9 trillion-peso ($162.7 billion) infrastructure program, the issue of funding arises.

“There is urgency for fiscal reform measures to further boost revenue through new or higher taxes, intensified collections as well as more disciplined government spending,” said Rizal Commercial Banking Corp. chief economist Michael Ricafort.

Still, Marcos’s market-friendly policies helped boost local stocks in his first year in office, with the key index gaining more than 5% since June 2022, far outpacing the market’s performance in the first year of former President Rodrigo Duterte.

The economic team is pushing for taxes on junk foods, plastics and digital services. The government is also trying to woo private companies to help build airports, railways and other key infrastructure as it seeks to ease fiscal burden and bring the budget shortfall to 3% of economic output by the end of Marcos’s term in 2028 from around 7% last year.

Investments

Marcos has made 13 foreign trips since he took power a year ago, securing a total 3.48 trillion pesos in investment pledges from his official visits, his office said in February. Of that amount, 239 billion pesos have materialized in various stages of implementation.

While more sectors including renewables have been opened up to overseas investors, more needs to be done to enable the Philippines to catch up with its neighbors. Net foreign direct investments fell 19.6% year-on-year in the first quarter to $2 billion after dropping more than 23% in the full year of 2022.

“There’s a global movement right now where everyone’s moving their supply chain, and the Philippines is right smack at the center of where the trend is going,” said HSBC Holdings Plc Asean economist Aris Dacanay. “You need to be able to build upon that trend.”

--With assistance from Ian Sayson.

(Adds stock market’s performance in 14th paragraph.)

Author: Andreo Calonzo and Manolo Serapio Jr.