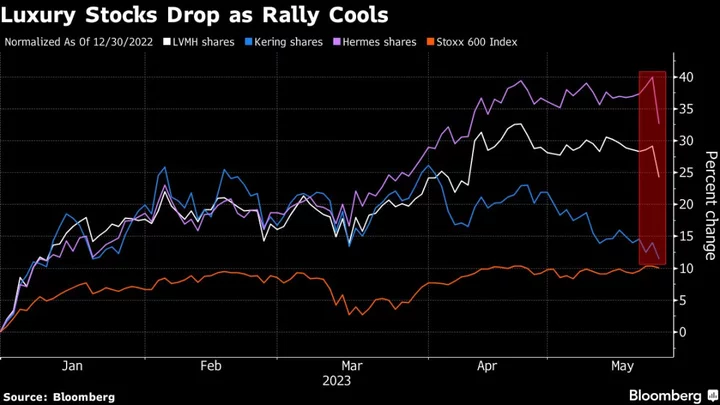

A rout in European luxury stocks is wiping more than $30 billion off the sector on Tuesday, after a blistering rally that had been fueled by bets of a boost from China’s reopening.

Shares in Hermes International slumped as much as 5%, while LVMH Moet Hennessy Louis Vuitton SE dropped 4% and Gucci owner Kering SA saw its stock drop over 2%. The high-flying sector tumbled after Deutsche Bank AG analysts said a slowdown in the US is a growing concern.

While the rebound in Chinese demand has been among the key drivers of strong sales, investors will likely be picky from here on, they added.

“The luxury sector remains a crowded long for many investors, with the sector’s premium to the market at historically high levels,” Deutsche Bank analyst Matt Garland said in a note. “We expect performance to be driven more by earnings momentum and expect investors to become more selective.”

Kering shares have gained 12% this year, while LVMH is up over 24% and Hermes has added 33%, all outperforming a 10% rise in the broader Stoxx Europe 600 Index.

--With assistance from Thyagaraju Adinarayan.