Buy-now-pay-later services will hit a record this holiday as increasingly cash-strapped US shoppers struggle with higher prices and rising borrowing costs, according to projections from Adobe Analytics.

Online spending using those services, which stretch payments over a longer period of time, will reach $17 billion in November and December — 17% higher than last year — as shoppers use the option to help manage their budgets, Adobe said in a report looking forward at e-commerce during the holidays. Consumers have become more hesitant to make purchases and will prioritize services and essential goods this holiday season, according to the report.

“Consumers are very price conscious,” said Vivek Pandya, lead analyst for Adobe Digital Insights, in an interview. “Because of inflation, we’re seeing their debt levels increase and their savings level decrease.”

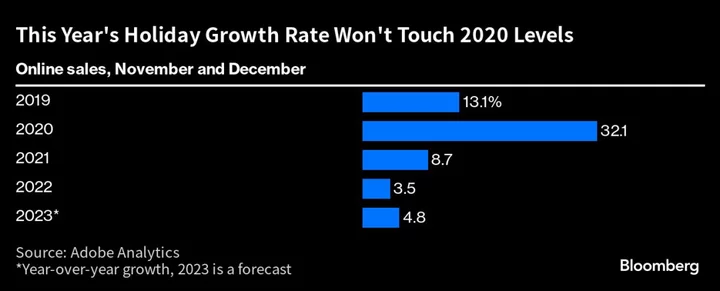

Total online sales will rise 4.8% during November and December, according to the report. That’s better than last year’s 3.5% growth, but well below the pre-pandemic level of 13% that was registered in 2019.

Buy-now-pay-later services will be especially popular among younger shoppers such as Gen Z and Millennials, Pandya said. “Their disposable incomes tend to be a bit more constrained, especially on the Gen Z side. So, it becomes about how they can stretch their dollars further.”

Grocery spending is another indicator that consumers are feeling crunched, with spending in the area expected to jump nearly 11% during the holiday months — by far outpacing other categories such as electronics and home goods.

See also: Gas, Interest Take Most Out of American Incomes Since 2014

Adobe sees retailers offering more discounts in a bid to boost their sales during the crucial period, with price reductions on toys expected to be particularly deep. Companies will also offer bigger promotions on electronics and apparel this year, according to the projections.

Adobe isn’t alone in projecting financial constraints weighing on shoppers. Consumers are now more focused on buying essentials, said Jennifer Silverberg, chief executive officer of consumer company-consultant SmartCommerce.

“There’s definitely, undoubtedly, going to be a shift toward more practical gift giving and more practical buying,” she said. “Economic realities are going to have an impact on these holidays.”

Deloitte sees US holiday retail sales growing 3.5% to 4.6%, slower than last year’s 7.6%. While healthy employment and income growth should buoy results, higher prices and a decreasing pool of pandemic savings will weigh on sales, Deloitte said in a Sept. 13 report.

A survey from market researcher NIQ, meanwhile, shows that more than 80% of US adults are planning to spend the same or less on holiday gatherings and celebrations this year.

Not all consumers are feeling the pinch. Costco Wholesale Corp. Chief Financial Officer Richard Galanti said last week that the holiday season is off to a good start. The company is bringing in smaller impulse snacks to offset some of the weakness that the warehouse chain is seeing in big-ticket items.

Discount retailers from Walmart Inc. to TJX Cos. may also benefit as consumers seek out lower prices.

See also: Luxury Shoppers Seek Holiday Season Discounts, Saks Survey Says

Student loans, which affect some 46 million Americans, are another variable after the end of pandemic moratoriums on payments. President Joe Biden’s administration announced this week it’s canceling an additional $9 billion in student-loan debt after the Supreme Court blocked his debt-relief plan. Loan payments average about $265 a month, according to NIQ data.

“You have a big set of people for whom that is a giant disruption in their life, and it’s hitting them at the time when they have to think about the yearly disruption for holiday spending,” said SmartCommerce’s Silverberg. “I think this is going to be a little bit harder.”