For the first time in three years, Goldman Sachs Group Inc. analysts say it’s time to buy shares of Heineken NV.

The Dutch maker of lager beer is set to benefit from an improving economic outlook in Vietnam, a growing market share in Brazil and a promising start in the US for its new premium brand Heineken Silver, Olivier Nicolai and his team wrote in a note.

The stock gained as much as 2.7% to €98.32 in Amsterdam as the analysts raised their rating from neutral and assigned a 12-month price target of €118 a share, implying 23% upside from the last close.

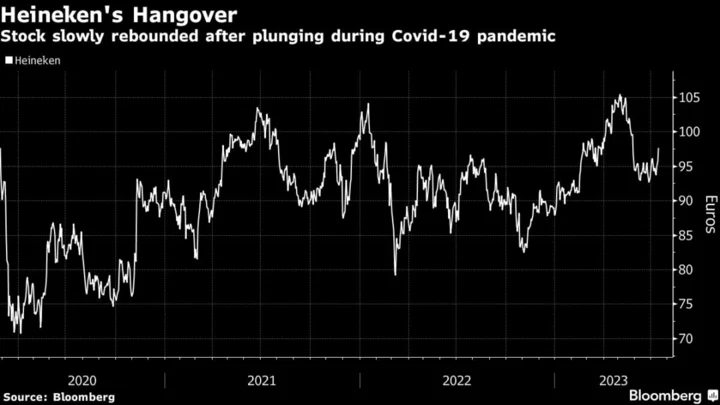

The bank’s neutral view on Heineken had until now proved a good call. Since Goldman’s February 2020 initiation, the shares had fallen roughly 2% through Thursday’s close. Danish rival Carlsberg A/S, meanwhile, has risen about 25% since the bank recommended buying the stock in May 2020.

Heineken recovered its pandemic-fueled losses earlier this year, only to slump in May after Mexican Coca-Cola bottler Femsa divested its stake in the brewer. The next catalyst for the stock may come on July 31, when first-half results are due.

Heineken’s Outlook Depends on Premium-Volume Sales: 1H Preview

Goldman said Heineken’s profit margins are at a “tipping point” as cost inflation is about to ease.

Brewers have faced more expensive wages, as well as higher costs of energy and raw materials such as barley in the past year. Some firms have attempted to pass those added costs onto beer drinkers, spurring worries about demand.