European equities posted their sixth straight session of declines on Wednesday, as the recent rise in oil prices and weak economic data from Germany added to concerns that the region is headed for stagflation, while luxury stocks dropped.

The Stoxx Europe 600 Index closed 0.6% lower in London, with the bulk of its sectoral subindexes in the red. German factory orders plummeted in July, in another sign that the woes of Europe’s biggest economy continued into the third quarter. Polish equities came under pressure as banking stocks fell after the country’s central bank cut interest rates for the first time in three years ahead of an election.

Luxury stocks were notable laggards in the region, adding to their recent declines amid persistent worries about a slowdown in the Chinese economy, a key market for the industry. Adding to the malaise, Richemont Chairman Johann Rupert said inflation is starting to dent demand across the Europe, while HSBC Holdings Plc published a note cutting estimates and prices targets across the space.

“The downgrade from HSBC triggered the reaction of the market today but the main reason is what we have been saying since the end of May: it’s the slower than expected rebound in China,” Jie Zhang, analyst at AlphaValue, said. “One can also add that international is not recovering as fast as expected. Until these factors materially change, we expect the sector to remain sluggish and on a negative trend.”

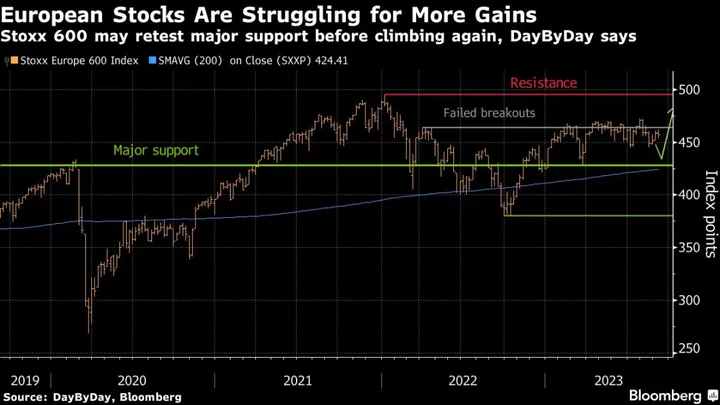

European stocks have been stuck in the same 5% range since April, with neutral breadth hiding still-negative sentiment. The most recent weakness came amid fears the euro area will be mired in stagflation should inflation prove stickier than anticipated, causing the European Central Bank to persist with interest-rate increases, while tepid growth morphs into recession.

“There’s a risk that with oil prices rising back to November highs, investors will worry about what the ECB will do next week ,” says Alexandre Baradez, chief market analyst at IG Markets in Paris. “Sentiment had been improving since the US job data last week, but now rising commodities are starting to change the picture when it comes to inflation.”

ECB Governing Council member Francois Villeroy de Galhau on Wednesday said interest rates are near a peak, but declined to indicate if that means the institution should hike or hold rates steady next week.

Governing Council member Klaas Knot warned, however, that investors betting against an ECB rate increase next week are “maybe” underestimating the likelihood of it happening.

Real estate, which typically benefits from lower interest rates, was the top-gaining sectoral index.

For more on equity markets:

- Equity Benchmarks Are Stuck in the Waiting Game: Taking Stock

- M&A Watch Europe: Saudi Telecom Buys Telefonica Stake; UBS

- Arm’s Valuation Falls Short of Lofty Expectations: ECM Watch

- US Stock Futures Unchanged; Zscaler Falls

- Ashtead Revenue Held Back by Hollywood Strike: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst

--With assistance from Kit Rees.