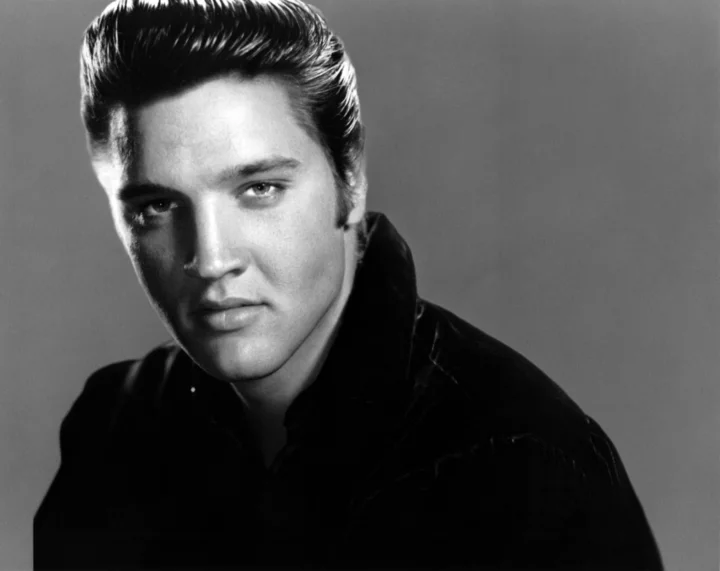

Elvis Presley’s fans are breathing life back into Graceland, the singer’s 120-acre Memphis estate that’s been preserved in his honor. The uptick in attendance has allowed its operators to make up some missed debt payments.

Borrowers now have enough funds to make a full payment of July interest after an earlier shortfall, according to a regulatory filing by the trustee on Friday. The bonds were issued to help fund an overhaul of the complex.

The Graceland complex got a revamp a few years ago, adding a hotel and new museum complex featuring the singer’s jumpsuits and private jets. But like other attractions, Graceland suffered a plunge in visitors as the pandemic halted tourism, leaving a shortfall in funds needed to make bond payments. Things seemed to turn around as attendance rose to 133,627 in the third quarter of 2022, up from 68,961 in the last part of 2021, according to bond documents. Hotel occupancy and room rates climbed during the period as well. But numbers from the third quarter of this year dipped a bit, with 130,497 visitors.

Read More: This $5 Billion Business Sells Elvis and Michael Jackson

Additionally, Presley’s licensing revenue has doubled from a year ago, said Jamie Salter, the founder and chief executive officer of Authentic Brands Group, the multibillion-dollar brand company whose portfolio includes Sports Illustrated, Forever 21 and the rights to celebrity names like Marilyn Monroe. That includes a bump in music streaming and merchandise sales. Authentic bought Presley’s intellectual property a decade ago and owns a minority stake in Graceland.

The boost in revenue was also bolstered by last year’s blockbuster biopic by Australian film director Baz Luhrmann. “The film made a lot of people aware of Elvis, especially the younger generation,” Salter added.

Missed Payments

In July, US Bank, the trustee on the debt, said it couldn’t make the July 1 principal and interest payments on a series of bonds sold by Memphis-Shelby County Industrial Development Board in 2017 to expand and renovate the Graceland complex. The borrowers paid only about $790,000 of the roughly $1.8 million due in July, putting that debt into default. This month, the trustee said it will pay the rest of that July interest payment.

Read More: Graceland Muni Bonds Default as Tourism Recovery Comes Too Late

The bonds are backed by tourist development zone revenue based on incremental sales activity calculated over a July through June period and disbursed once a year in September or October, S&P Global Ratings analyst Randy Layman said in an email. Tourism “materially rebounded” in the latest July to June period, contributing revenue toward the overdue payments.

A state law passed last year that changes how tourism revenue is calculated will also help, he said. Layman only rates the 2017B series, which is current in payments. An earlier default on subordinate bonds remains in effect.

Attendance is often cyclical and climbs around events like the anniversary of Presley’s death, Layman said in an interview. Even with the dip, the latest numbers “are still pretty good, and it’s notable that Q1 and Q2 were the first quarters where visitors were above prepandemic figures.”

“It’s kind of a generational thing and there’s baby boomers entering retirement and there’s some extra free time to go to places like Graceland,” Layman said.

--With assistance from Joe Mysak.

Author: Lauren Coleman-Lochner