Economists are downgrading their forecasts for Hong Kong’s economic growth this year following worse-than-expected data for the second quarter.

DBS Group Holdings lowered its forecast for gross domestic product growth in 2023 to 4.8% from 6.5%, citing weak trade figures and tepid investment sentiment, according to a note on Tuesday.

United Overseas Bank Ltd. slashed its estimate to 4.2% from 5.5%, while Capital Economics Ltd. expects growth of 5.5% this year, down from a previous projection of 6.5%. Citigroup Inc. economists cut their forecast to 4% from 4.5%, and Natixis SA revised down its forecast to 4.2% from 4.6%.

After contracting in three of the past four years, the economy was expected to rebound strongly this year as consumer spending and tourism recovered with the city’s reopening. However, growth is now being hampered by a slowdown in the global economy and China’s faltering recovery, which has cut demand for Hong Kong’s exports.

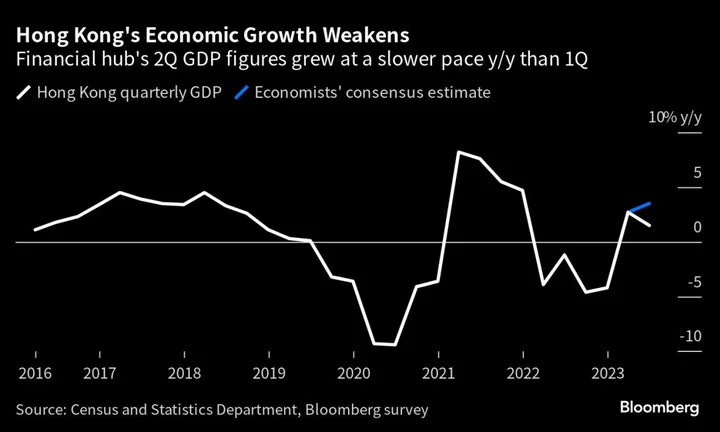

Official data on Monday showed Hong Kong’s post-pandemic boom has run out of steam, with GDP expanding 1.5% in the second quarter from a year ago, far weaker than the 3.5% estimated by economists. Officials earlier this year estimated that annual growth would reach between 3.5% and 5.5%, and economists are now thinking the city may only hit the low end of that range.

“Similar to China’s data trend, Hong Kong’s recovery momentum softened in the second quarter after the strong bounce in the first quarter,” Citigroup economist Adrienne Lui wrote in a research note. “We remain constructive that the Hong Kong recovery is still ongoing, but the post-reopening easy recovery is done, the next stage of recovery requires local efforts to unblock capacity bottlenecks and China to recover on a broad based manner.”

Financial Secretary Paul Chan has flagged more muted spending habits among residents, saying recently that they are in some cases taking their money to neighboring Shenzhen, which has emerged as a popular tourist and shopping destination.

A slower growth rate for sales hasn’t yet been “fully reflected” in data, according to Gary Ng, a senior economist at Natixis — though he added that he believes Chan “is still right to worry.”

The city’s retail sales growth accelerated to 19.6% in June from a year prior, according to government data released Tuesday. That was higher than the 18.4% year-on-year rise in May.

These figures compare, though, to a period last year when sales were contracting as the city maintained strict pandemic curbs.

“The structural challenges are increasingly apparent as the sales value is only 88% of the 2018 level,” Ng said. “The changing spending pattern of Chinese tourists means Hong Kong will need to adjust its tourism business model. As more luxury brands open direct sales channels in mainland China with narrowed price differences, Hong Kong may be less attractive than before.”

Visitor arrivals to the city were down 2.8% in June from the month before, according to the Hong Kong Tourism Board. Visitors from mainland China were down 5.7%.

The impact on spending will become “even more obvious” when the effects from city consumption vouchers fade, according to Ng. The city most recently disbursed vouchers last month.

--With assistance from Kari Lindberg.

(Updates with retail sales data and expert commentary.)