Walt Disney Co. rose more than 6% in extended trading after management of the world’s largest entertainment company said capital spending and outlays for movies and TV shows are coming in lower than projected.

Disney expects content spending this year to total about $27 billion, Kevin Lansberry, acting chief financial officer, said Wednesday on a call with investors after the company posted third-quarter results. Disney typically spends about $30 billion.

The savings are partly as a result of production cuts tied to writer and actor strikes in Hollywood, he said. Disney also forecasts capital spending of $5 billion, lower than projected previously, as the company shifts the timing of some projects.

The comments buoyed investors and lifted shares of Disney as much as 6.1% to $92.80 in extended trading. They had been down earlier.

Earlier Wednesday, Disney reported fiscal third-quarter profit of $1.03 a share, beating the 99-cent average of estimates compiled by Bloomberg. Sales grew 3.8% to $22.3 billion in the quarter ended July 1, missing analysts’ projections slightly.

During the period, Disney’s online video operation cut its loss to $512 million from more than $1 billion a year ago. Just three months ago, management predicted the direct-to-consumer business would lose more than $750 million in the quarter.

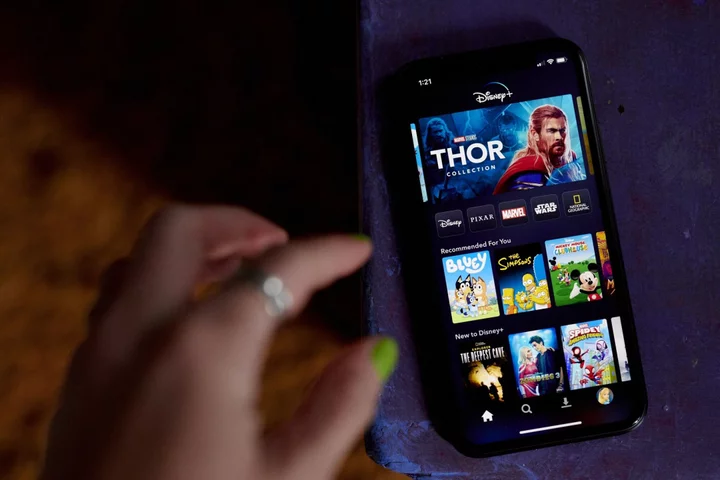

But subscribers to the Disney+ streaming service tumbled 7.4% to 146.1 million from the previous three months, missing the 154.8 million consensus analysts had expected. Nearly all of that shortfall was borne by the company’s Disney+ Hotstar in Asia. It lost almost 25% of its customers after Disney failed to renew streaming rights for popular cricket games in the Indian Premier League.

The company also announced it is raising prices for some streaming subscriptions by as much as 27%.

Read more: Disney Raises Prices for Streaming by Up to 27%

The world’s largest entertainment company launched an extensive cost-cutting effort after Chief Executive Officer Bob Iger returned to run the company in November. That included 7,000 job cuts and other reductions in spending.

As part of that effort, Disney recorded $2.44 billion in costs in the third quarter to remove shows and movies from its online services and terminate deals with outside producers, greater than earlier projections. The company also recorded charges of $210 million due to severance costs. In a statement Wednesday, Iger said he expects to exceed the overall cost-cutting target of $5.5 billion.

Disney reported a 23% decline in profit, to $1.89 billion, in traditional TV — underscoring the troubles confronting that division. The business, which includes channels such as ABC and ESPN, has been buffeted by falling cable subscribers, lower broadcast advertising sales and higher programming costs for sports.

The company’s theme-park business, the world’s largest, earned $2.43 billion, an 11% increase from last year. Weakness at the Florida resorts was offset by a huge swing to profitability at the international theme parks.

Disney is in the throes of major upheaval: Iger signaled in a July interview with CNBC that TV networks including ABC, Freeform and FX, which contributed about half of Disney’s operating income before the pandemic, “may not be core” to the company any longer.

He’s also seeking to sell a stake in the ESPN sports business to a partner that can help accelerate the network’s transition to streaming. Iger recently hired former lieutenants Kevin Mayer and Tom Staggs as consultants to advise on that effort.

On Tuesday, ESPN announced a long-term agreement with casino operator Penn Entertainment Inc. to license its brand for sports betting. Penn will make cash payments totaling $1.5 billion over the 10-year term and grant ESPN $500 million of warrants to purchase Penn shares.

The company is also conducting a search for a new chief financial officer after longtime executive Christine McCarthy left that position in July.

Read more: ESPN Is Getting Into Sports Betting With Penn Entertainment