Asian stocks look set to follow Wall Street lower as investors contemplate a protracted period of higher interest rates. The dollar extended its winning streak for a fifth day.

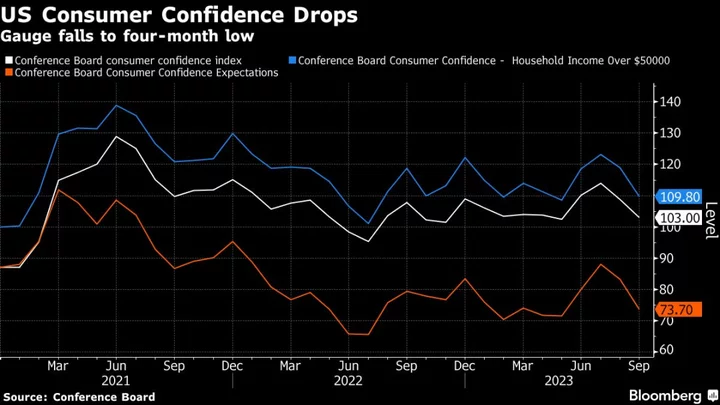

Stock futures in Japan, Australia and Hong Kong all declined. The S&P 500 Index lost 1.5% and the Nasdaq 100 slumped 1.6% Tuesday as Wall Street’s fear gauge — the Cboe Volatility Index or VIX — hit the highest since late May after US consumer confidence fell to a four-month low. The MSCI All Country World Index, one of the broadest measures of global equities, fell for an eighth day, matching its longest losing streak in the past decade.

“The market is in the hands of the bears right now,” said Quincy Krosby, chief global strategist for LPL Financial. “It’s a wall of worry, uncertainty hovering over the market. You wouldn’t say that the selloffs have been tremendously dramatic — in fact, they’ve been kind of orderly. But there’s still that uncertainty.”

Data showed consumer confidence dropped to 103 from a revised 108.7 in August, missing the median estimate of 105.5 in a Bloomberg survey of economists. Separate reports also showed purchases of new homes fell to a five-month low while home prices in the US rose to a record high over the summer as buyers battled over a tight supply of listings.

Costco Wholesale Corp.’s quarterly report showed comparable sales that mostly trailed analyst estimates suggesting shoppers are cutting back on their discretionary spending. Tech giants, namely Apple Inc., Microsoft Corp., Amazon.com Inc. and Google-parent Alphabet Inc. dragged on the US stock gauges, pushing the tech sector down more than 10% from a July peak from the threat of tight policy.

Read more: Tech Stocks Enter a Correction as Fed Fear Dents Market Heroes

Yields on Treasuries remain near decade highs after a $48 billion Treasury auction of two-year notes was awarded at 5.085%, the highest since 2006. The Bloomberg dollar index advanced, setting a fresh 2023 peak in its strongest close since early December. The yen remains near 149 per dollar, keeping traders on edge for any step up in language from Japanese officials to gauge whether intervention to support the yen is on the horizon. Oil resumed its climb, moving back above $90 a barrel.

One Fed speaker after another in the past week has delivered emphatic messages that they will keep policy tighter for longer if the economy is stronger than expected. Federal Reserve Bank of Minneapolis President Neel Kashkari said he expects the US central bank will need to raise interest rates one more time this year.

“Investors are beginning to realize that a ‘higher for longer’ interest rate environment is a likely outcome and are slowly adjusting to the ‘new normal,’” Paul Nolte, a senior wealth manager at Murphy & Sylvest Wealth Management, wrote in a note. “Higher-for-longer has been the mantra of the Fed for a few months. It is only recently that the markets have been taking them at their word.”

Meanwhile, Senate Democratic and Republican leaders agreed Tuesday on a plan to keep the government open through mid-November and provide $6 billion in assistance to Ukraine. The plan to avert a shutdown on Oct. 1 still needs to overcome gridlock in the House.

Investors “seem to favor the cut-run manoeuvre this week,” said Stephen Innes, managing partner at SPI Asset Management. “Heightened investor anxiety due to the looming possibility of a partial US government shutdown is not helping matters.”

In commodities, precious metals fell, sending gold down to about $1,900 an ounce.

Key events this week:

- China industrial profits, Wednesday

- US durable goods, Wednesday

- Eurozone economic confidence, consumer confidence, Thursday

- US initial jobless claims, GDP, Thursday

- Fed Chair Jerome Powell town hall meeting with educators while Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee make speeches, Thursday

- Eurozone CPI, Friday

- Japan unemployment, industrial production, retail sales, Tokyo CPI, Friday

- US consumer spending, wholesale inventories, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 7:11 a.m. Tokyo time. The S&P 500 fell 1.5%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 1.5%

- Hang Seng futures fell 0.3%

- Nikkei 225 futures fell 0.6%

- S&P/ASX 200 futures fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was little changed at $1.0571

- The Japanese yen was little changed at 149.04 per dollar

- The offshore yuan was little changed at 7.3104 per dollar

- The Australian dollar was little changed at $0.6396

Cryptocurrencies

- Bitcoin rose 0.1% to $26,176.82

- Ether rose 0.2% to $1,589.45

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Vildana Hajric and Isabelle Lee.