The resilient American shopper is showing more signs of weakness.

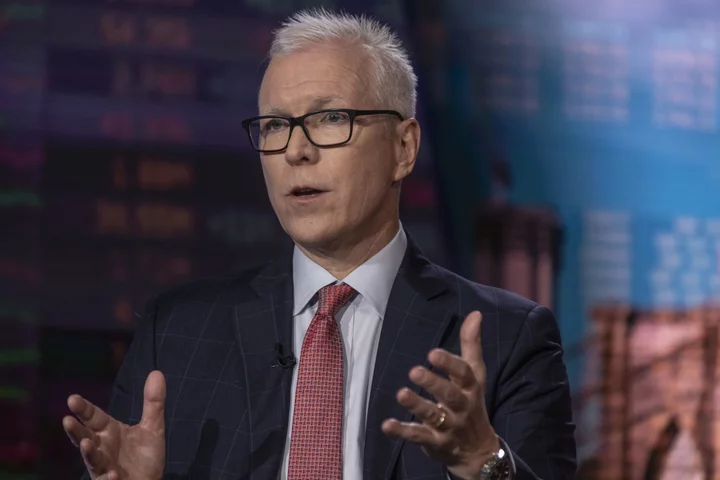

Over the past year, many US consumers responded to surging inflation by trading down to cheaper options. But now they’re just going without, said Sean Connolly, chief executive officer of Conagra Brands Inc., during an earnings call. The behavioral shift began shortly after the Easter holiday in early April, he said.

“Importantly, where we see it, it is usually not a trade down to lower-priced alternatives within the category; rather, it’s an overall category slowdown,” he said. Connolly added that he expects the behavior is short term and that “people aren’t eating less.”

Read More: In Troubling Sign, Shoppers Skimp on Toothpaste

Certain grocery categories are feeling the pullback more than others, according to data from researcher NIQ. In food, overall units sold are down 2% this year, with some of the biggest declines coming in frozen meals, fruit juice and soup.

People are likely “burning through inventory in their homes,” said NIQ’s Carman Allison. “We’re spending more, but we’re buying less.”

Conagra’s results point to the dilemma facing consumer-focused companies that have relied on price increases to make up for softness in the number of items they’ve been selling. In the quarter ended May 28, the owner of the Slim Jim brand reported a 7.7% drop in volume, but revenue rose 2.2% thanks largely to higher prices.

In an interview, Connolly said that Americans are away from home more often and shifting spending to other categories.

“The consumer is very creative and very crafty in terms of finding ways to stretch their budget,” he said. “One of the ways they make that happen is they just cut back temporarily on the stuff that they buy in order to be able to fund other expenses. That’s what we believe.”