Alibaba Group Holding Ltd.’s surprise move to fully spin out a potentially transformative $12 billion cloud business is stirring speculation about whether the Chinese e-commerce leader bowed to market or political realities.

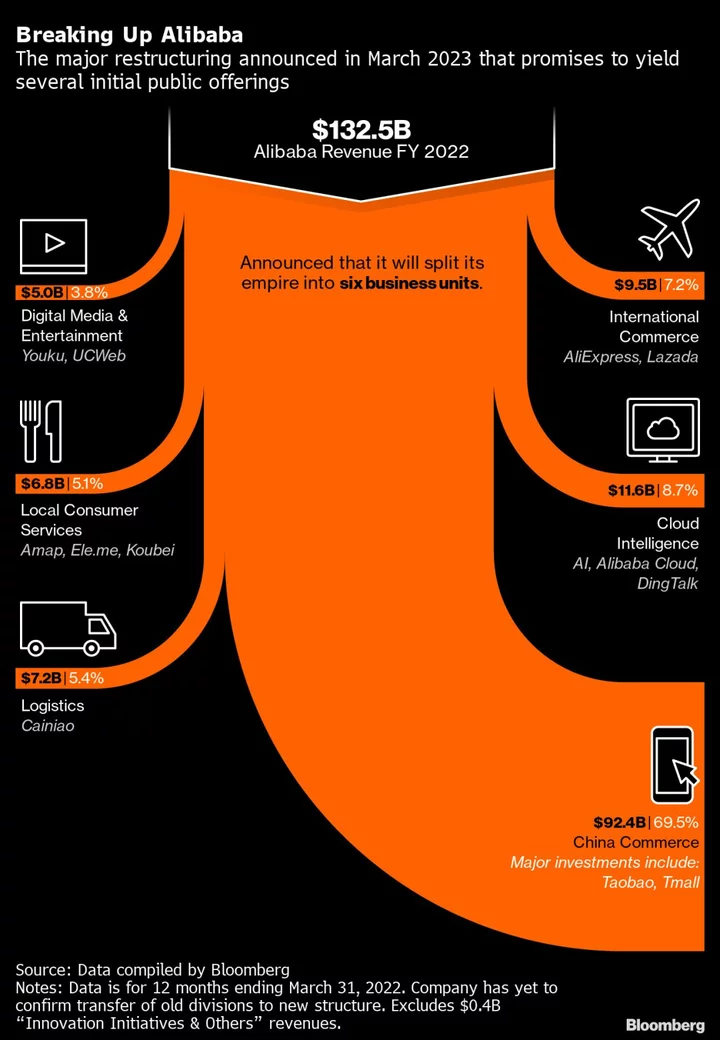

Chief Executive Officer Daniel Zhang dropped a bombshell Thursday when he unveiled the contours of Alibaba’s historic six-way shakeup for the first time. Included among the listing and financing of a plethora of businesses was a plan to fully relinquish control of the business known as Alibaba Cloud, a once-thriving operation that harbored the potential to supercharge the company the way Amazon Web Services grew to signify Amazon.com Inc.

At the heart of the issue is why Alibaba chose to sever a business some analysts value at upwards of $30 billion, a prime beneficiary of a post-ChatGPT upswell that depends on cloud resources to train next-generation AI models. In doing so, it’s hiving off a unit that comes with historical baggage and its own share of business uncertainty. Alibaba dived as much as 5.9% in Hong Kong Friday, after also reporting disappointing Chinese commerce figures.

China’s most valuable online commerce firm invested tens of billions over more than a decade in the business of hosting computing for corporations over the internet. For years, it was among Alibaba’s proudest and most often-touted accomplishments, a business that outstripped rival offerings from Tencent Holdings Ltd. and Baidu Inc., grew more global in flavor than any other division, and spearheaded important inhouse initiatives.

But government scrutiny of cloud services operated by private firms intensified around 2020, when Beijing grew suspicious of privately owned repositories of sensitive and valuable data, triggering a now-infamous sweeping crackdown on the internet sphere. AliCloud itself drew regulatory ire in 2021 for discovering then sharing a major software flaw before informing authorities, and was then investigated in 2022 for its role in China’s largest known cybersecurity data leak. The cloud division in recent years began to bleed market share to rivals including Huawei Technologies Co. and state-run China Mobile Ltd.

“It’s positive for shareholders as it represents a significant capital return, but once fully distributed the cloud business will no longer add to Alibaba Holdco’s valuation,” said Vey Sern Ling, managing director at Union Bancaire Privee. “The company says cloud business is relatively independent and unrelated to its core e-commerce businesses. But investors may wonder if the government told them to break up.”

Read more: Alibaba Breakup Begins With Spinoff of $12 Billion Cloud Arm

Key Points of the Breakup Blueprint

- Alibaba plans to spin off its cloud services division as an independent entity by distributing stock to shareholders over the next year

- That means Alibaba could eventually end up not owning shares in China’s biggest cloud services platform

- It will aim to float its Cainiao logistics arm within 12 to 18 months

- Most immediately, the firm aims to complete an IPO for the Freshippo grocery chain within the coming year

- And it plans to secure external financing for its international commerce division, which encompasses overseas operations such as Singapore-based Lazada

Like Amazon’s, Alibaba’s cloud service emerged from the computational power needed to handle millions of simultaneous online shopping transactions. But unlike its US counterpart, it enjoyed home-field advantage in a vast Chinese market where web-based computing was (and still is) novel to many enterprises. Its push into the cloud, where software and services are provided to customers via server farms the size of football fields, was once envisioned as helping cushion Alibaba against domestic shocks to its core operation.

Zhang said Thursday the cloud arm pretty much runs itself as an independent operation. But it’s also inextricably intertwined with some of the company’s most pivotal undertakings.

Cloud drives its signature Singles’ Day gala, an annual event that showcases the company’s enormous global reach in online shopping. It helped power hundreds of thousands of transactions per second — a phenomenal endeavor Alibaba has unfailingly credited the cloud division with enabling. The unit contributed to profit for the first time around late 2020, helping prop up the bottom line just as Covid-era shocks hammered shopping. And it houses the DAMO academy that works on potentially groundbreaking, moonshot projects from chip design to quantum computing.

Read more: Scrutiny of Alibaba in Record Breach May Ensnare All China Tech

In fiscal 2022, it generated nearly $12 billion of revenue for the company — 8% of turnover. It was so important that in March, when Alibaba first unveiled its six-way breakup, Zhang personally took the helm of what he called the Cloud Intelligence division — seemingly signaling it was destined for greater things.

“This full spinoff plan involving AliCloud is both bold and puzzling,” Nomura Holdings Inc analysts Jialong Shi and Thomas Shen wrote in a note. Their current valuation for the unit stands at about $31 billion. “AliCloud is BABA’s organic business and is still deemed as one of the long-term drivers for the group even though its growth temporarily slowed down in recent quarters due to macro headwinds. That is why we find it puzzling that BABA has decided to fully spin off this business instead of retaining a minority stake at least.”

The tide had turned against the business several years before. Beijing’s relentless and widespread crackdown on its formerly high-flying tech giants since late 2020 had nudged risk-averse institutions toward state-owned providers.

Large-scale businesses like the China Construction Bank and local municipalities in cities such as Nantong were already moving closer to state-backed cloud platforms, Bloomberg News has reported.

Ultimately, Alibaba may have acceded to business considerations. Zhang said the cloud spinoff was intended to simplify the structure and respond to market needs. A standalone platform could grow to someday even surpass Alibaba in size if it attracted the right external financing, he told analysts Thursday without elaborating.

“The planned spin-out comes at a challenging time for the Cloud business, which seems to have lost the growth initiative,” said Bloomberg Intelligence analyst Robert Lea.

Read more: Alibaba’s $32 Billion Day Signals Breakups for China Tech

--With assistance from Vlad Savov.