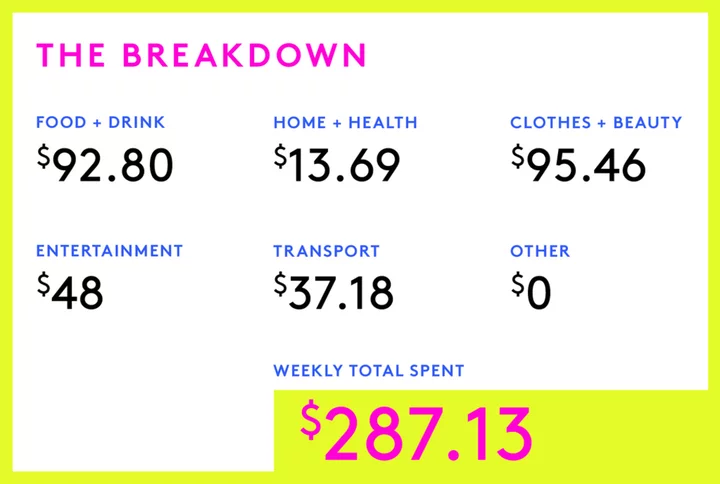

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an operations analyst who makes $80,000 per year and spends some of her money this week on a Dunkin’ iced coffee.

Occupation: Operations Analyst

Industry: Health Insurance

Age: 31

Location: North Shore, MA

Salary: $80,000 ($75,000 full-time job and ~$5,000 part-time job).

Net Worth: -$24,263 (checking: $741, savings: $40,703.37, 401(k): $18,799, car: $16,023, minus debt).

Debt: private student loan: $64,175, federal student loan: $19,435.35.

Paycheck Amount (biweekly): full-time job: $2,020 (after deductions), part-time job: ~$500 (varies around how many hours worked).

Pronouns: She/her

Monthly Expenses

Rent: $0 (I currently live with my family and my parents are pretty traditional (Caribbean) in the sense that they don’t expect any of their children to pay rent while living at home).

Federal Student Loans: $0 (paused).

Private Student Loans: $1,500 (I pay more than the minimum).

Health Insurance: $187.80 (includes dental and vision, deducted pre-tax).

401(k): $86.54 (my company matches this in full, deducted pre-tax).

Car Insurance: $204 (my car is fully paid off).

Cable/Wi-Fi: $77 (my half; my brother and I cover this bill).

Cell Phone: $55

Pet Insurance: $41 (my half, split with my brother).

Gym: $23

Disney+: $2.99 (they sent me this promo price about two years ago and the price has never changed).

Netflix: $0 (my brother pays).

Emergency Fund: $200 (I have almost four months’ worth of expenses saved up so once that’s fully funded, I’ll allocate this amount elsewhere).

Sinking Funds: $540 (I have a few different sinking funds like car, dog, travel etc.).

Annual Expenses

Amazon Prime: $23 (my share; my siblings and I split this cost and use one account).

Hulu: $80 (shared with my siblings).

Spotify: $99

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Absolutely. There was no other path that my parents expected me to take. They are Caribbean immigrants to this country and they saw education as the way out of poverty. I always did well in school, so college was on my radar. I went to an expensive private college for undergrad and lived on campus. I took out loans for all four years (there was no way my parents could afford college for all three kids) and graduated with over $100,000 in student loans. Knowing what I know now, I would’ve done this all very differently.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Not much. Money seemed to be a pretty taboo topic back then but I knew we didn’t have a lot of it to go around. My parents also have very different money habits, which has caused a lot of strife between them. I only remember hearing that I should always save and maintain a good credit score but not exactly how to do that. Most of my financial knowledge has come from educating myself over the last few years. I zero-base budget and keep an expense tracking spreadsheet that I update on a daily/weekly basis. Having a visual of where all my money is going removes a lot of financial anxiety for me.

What was your first job and why did you get it?

I got my first job at the local supermarket as a cashier when I was 17. Some of my friends worked there and I wanted spending money for fun stuff.

Did you worry about money growing up?

Yes. My parents took care of our basic financial needs but they also worked long hours to make ends meet. I’d hear a lot of “we can’t afford that” so I was very excited when I got to make my own money and buy things for myself.

Do you worry about money now?

Yes and no. When I got my first job out of college, I was making $16.50 an hour and thought I was living large… until I got my first student loan bill and it was basically a whole paycheck. I’ve since moved around to different jobs and companies and feel like I’m at a decent salary now. My student loans definitely influence all the decisions I make about money and I worry that I’ll never be rid of them. I’ve had to learn about budgeting, an emergency fund, retirement funds, how interest works etc. to grasp how I can be debt-free one day.

At what age did you become financially responsible for yourself and do you have a financial safety net?

I know that not paying rent and/or other household bills automatically disqualifies me from the definition of being financially responsible for myself but I do handle all of my expenses on my own. It’s a great privilege to not pay rent or a mortgage, which I’m fully aware of, but it does cost me my mental health sometimes. As a woman in this culture, the expectation is that I live at home until I’m married. I have no desire to do this and hope to start looking at apartments to rent with a friend later this year (much to the dismay of my parents).

Do you or have you ever received passive or inherited income? If yes, please explain.

No.

Day One

8 a.m. — Happy Friday! I wake up and do my morning routine of brushing my teeth and skincare. I’m too lazy for much today so it’s just sunscreen (Paula’s Choice). I toss on shorts and a Free People tank. I let my dog out into the backyard and feed him breakfast. It’s also payday from my FT job so I move some money around, which includes $163 to my emergency fund (I use Ally) and a $475 payment to my private student loan (in monthly expenses).

9:30 a.m. — I head out to grab an iced coffee from Dunkin’ ($2.15) and also stop at the beauty supply store for some braiding hair ($25.46). $27.61

10:30 a.m. — I pay off my grocery credit card for the month. I use my Citi credit card for grocery purchases because I get 3% cashback. I don’t use this card as frequently anymore as I prefer my Chase cards for points, but I like to keep it active for my credit history. I have two reoccurring bills paid with this card, along with grocery purchases.

3 p.m. — I take my dog on our daily walk, which we limit to about a mile since it’s warm out.

5 p.m. — Time to log off! I started this position a few months ago but we had a system outage at the same time so my workload has been very limited. I take a quick shower, do my nightly skincare routine (CeraVe face wash, Heritage Store toner, CosRx snail mucin, Glossier After Baume cream) and toss on my pajamas. I make a quick dinner of grilled chicken wings, veggies and sweet potato fries and wash it down with a Poppi.

8 p.m. — I watch Missing on Netflix and then head to bed around 11. Wild Friday night.

Daily Total: $27.61

Day Two

9 a.m. — I’m up early to wash and blowdry my hair before my hair braiding appointment. I do the usual routine with the dog since we’re the only ones awake.

10 a.m. — I head out to my appointment and stop at one of my favorite local coffee shops. They finally opened one near me and I get my usual order with a piece of coffee cake. $8.27

11 a.m. — I get to my hair appointment and pay for parking in the public lot. $4

2 p.m. — Hair done! I normally have a short pixie cut and I’ve been growing it out since February to get it braided for my trip to Europe in a week. It cost $80 but I paid when I scheduled the appointment.

3 p.m. — Before I head home, I stop by my favorite Thai restaurant to grab takeout. We used to frequent this place for lunch when I still worked in the office and I miss it now that I work from home. I get two orders of veggie pad Thai (one for me and one for my mom). $23.54

5 p.m. — Finally home. I greet my dog and mom and head straight to a hot shower. Do my skincare (tonight is face wash, toner, snail mucin, Topicals Faded cream and moisturizer). I have an early dinner of my pad Thai and start watching The Summer I Turned Pretty. After a few episodes I head to bed.

Daily Total: $35.81

Day Three

8 a.m. — Up earlier than I’d like to be on a Sunday. I work at a local barre/yoga studio and absolutely love it. I’ve been going to the studio for four years now so when they were hiring for part-time help, I applied. I work three times a week and assist at the front desk, answer questions/emails, clean and order supplies. I get paid but I also get a free membership, which is a nice perk! I get ready, let the dog out/feed him and last-minute decide to make an iced latte with my Nespresso. I love using the Starbucks Blonde espresso pods.

8:45 a.m. — I get to the studio, chat with an instructor and prep for check-in.

10 a.m. — The instructor for the next class comes in and we chat about my trip to Europe. I’m heading there for 10 days with three of my close friends. I’m excited but also nervous! Pre-trip anxiety always gets the best of me. I finish check-in, lock the door and head into the studio room to take the yoga class.

12 p.m. — Class is done! We practice crow pose today and I manage to get off my feet for a whole three seconds. I clean up the studio, take out the trash, lock up and leave for the day. On my way home, I stop at CVS for toothpaste and Excedrin ($13.69). I use some coupons I have on my account. I also stop by Whole Foods and grab a cup of clam chowder ($5). $18.69

1 p.m. — I get home, greet my parents and the dog, and head up for a shower. Then I eat my soup and pair it with a homemade caesar salad. I walk the dog and spend the afternoon relaxing and watching TV.

6 p.m. — I text my friends about purchasing tickets for attractions we want to visit in Paris. I agree to purchase two sets of tickets and my friends will reimburse me. My portion is $48, which will come out of my travel sinking fund. $48

8 p.m. — My sister is moving back home from campus and she arrives! I help her unpack her car then brush my teeth, read (currently reading The Last Thing He Told Me on my Kindle, borrowed from the library) and fall asleep around 11.

Daily Total: $66.69

Day Four

8 a.m. — How is it already Monday again? Usual morning routine and taking care of the dog. I also make an iced latte and fill up my water bottle for the day.

11:30 a.m. — I’m not a big early-morning eater so I usually have my first meal at lunch. I make a bacon, egg and cheese with two Trader Joe’s hash browns on the side.

1:30 p.m. — The workday is slow with no meetings so I gladly go walk the dog and my mom comes along.

5 p.m. — I log off and head out to get my Brazilian wax. I really like my waxer but ow. Pain over and now I’m smooth like a baby seal. She gives me a returning client discount at $57 and I tip $13. $70

6 p.m. — I stop for gas and use my GasBuddy card for a discount. $33.18

6:30 p.m. — I stop by the supermarket to grab a few things I forgot to restock on my grocery run earlier this week. $7.33

8 p.m. — I make a steak and cheese sub for dinner while listening to a Dateline podcast episode. I drink a Ginger Lime Poppi while watching TV then go to bed.

Daily Total: $110.51

Day Five

8:30 a.m. — I’m slow to rise today. I do a full skincare routine (face wash, toner, The Ordinary hyaluronic acid, Naturium niacinamide, sunscreen). Usual dog duties, espresso, water. I also update my spending tracker with recent purchases.

12:30 p.m. — I make a turkey sandwich for lunch. I then take the dog on a 30-minute walk while listening to a podcast.

4 p.m. — I pack up my bag with my laptop, water and work phone and head to the studio for my evening shift. I meet with our manager and the other assistant to talk about what’s been happening for the past week. I periodically check my work email while I sit behind the desk during the first class of the evening.

6 p.m. — I take a barre class with my favorite instructor. After class, I clean up, handle check-ins for the last class of the day, lock the door and head out!

7:30 p.m. — On my way home I decide I want a sweet treat after dinner so I stop by my favorite local ice cream shop. I text my sister to see if she wants something. I get her a kiddie cookie dough ice cream and a small strawberry frappe for myself. Once home, I shower, do my skincare and hop onto my laptop to watch a free investing webinar that I signed up for. It’s hosted by one of the financial girlies I follow on IG. I like to try and learn where I can! I eat a dinner of rice, chicken and some avocado that my mom prepared. I drink my frappe, watch an episode of TSITP and read for a little before falling asleep. $12.51

Daily Total: $12.51

Day Six

7 a.m. — I’m up earlier than normal for no particular reason. I lie in bed and scroll on my phone.

8 a.m. — I finally roll out of bed, do my morning routine and take care of the dog. I join our team meeting while drinking my espresso. I also see that my Zoom settlement payment has been deposited into my account ($32.32). I totally forgot I had filled out the claim form way back when but hey, I’ll take some free money.

11:30 a.m. — Another day, another bacon, egg and cheese for lunch. I take the dog on a walk and listen to an episode of The Deck podcast. It’s a rainy, hazy day so we don’t go as far as usual.

4:30 p.m. — Log off and hop in the shower. I’m excited to do nothing for the next few hours. After I shower and do my skincare routine, I make a dinner of air-fried salmon, a caesar salad and sweet potato fries.

6 p.m. — I finish the last few episodes of TSITP. The ending!!! Can’t wait for the next season.

8:30 p.m. — I brush my teeth, add some oil to my diffuser and spend the rest of the night reading my book. Proud of myself for having a no-spend day!

Daily Total: $0

Day Seven

8 a.m. — Back at it again. I go to my local coffee shop and get a caramel iced coffee. $5

9 a.m. — I hop into meetings.

12 p.m. — Decide I want a cheeseburger for lunch so I turn on the grill outside to cook one. Then I walk the dog and listen to another podcast. Podcasts are what kept me sane during the pandemic. I used to listen to them on my commute to work (two hours round trip every day) and when that stopped, I started listening to them while doing other tasks like walking the dog, cooking, cleaning etc.

4 p.m. — My last shift at the studio before vacation! I tidy up a bit and handle check-ins for the first class. While class is happening, I decide to read my book.

5:30 p.m. — I pop into the convenience store across the street for some gum. $2

6 p.m. — Time for a barre class!

7 p.m. — I handle check-ins for the last class, then lock up and head out. My friend texts me to ask if I want to grab a margarita. YES! We head to a local Mexican restaurant.

9 p.m. — We spend the next two hours chatting, drinking (coconut marg for me) and catching up. We order a small combo plate of chorizo tacos and rice, which we split. We split the bill. $27

9:30 p.m. — I get home, quickly shower, do my nighttime routine and hop into bed. Finish reading my book and fall asleep.

Daily Total: $34

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more Money Diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.