Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an educator working in behavioral health who has a joint income of $112,488 per year and spends some of her money this week on botox.

All currency has been converted to USD.

Occupation: Educator

Industry: Behavioral Health

Age: 34

Location: Halifax, Nova Scotia, Canada

My Salary: $42,246

My Husband’s Salary: $70,242

Net Worth: $149,490 (my pension: ~$21,123, my husband’s pension: $105,698, my savings: $3,772, my husband’s savings: $3,397, RRSP: $1,131, house: ~$265,400. We bought our house for $275,365 in 2020, but it’s now valued at $452,640, and we have paid $37,720 into it. I drained my RRSP when purchasing it using the Home Buyers’ Plan credit. I can pay back the withdrawn funds in 13 years, but I’m paying it back a little at a time.)

Debt: $251,030 ($830 on my personal credit card, $12,564 for our car loan, and $237,636 remaining on our mortgage.)

My Paycheck Amount (2x/month): $1,072.76 (after taxes and deductions)

My Husband’s Paycheck Amount (2x/month): $1,629 (after taxes and deductions)

Pronouns: She/her

Monthly Expenses

Mortgage: $1,508.80 (I pay $377.20 of this total, because T. makes quite a bit more than me. Otherwise, we split expenses most of the time).

Car Loan: $414.92

Gym: $148

Phone: $63 (my phone is paid off; this is for service).

Health & Dental Benefits: $198.43 (T. has our family benefits deducted from his paychecks).

Childcare: $339–$415 (the total varies based on the number of days a month we need).

Heat Pumps: $83

Car & Home Insurance: $150.88

Apple Music Family Subscription: $15.10 (I share with my husband, dad, and two friends).

Crave: $3.77 (my friends and I share payment).

Netflix: (I mooch off my parents).

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

Yes. I have an M.Ed and plan to go back to school next year to become a Board Certified Behavior Analyst (BCBA). My parents both work in healthcare, have high levels of education, and are definitely disappointed that my brother and I haven’t met their same level of academic/career success.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

Not really. There were no concerns about money growing up. I did not receive any financial education and have inherited my mom’s love of shopping, without the salary to support such habits.

What was your first job and why did you get it?

I worked at a gourmet pizza shop in high school so I could buy magazines, nail polish, and whatever other trinkets my high-school heart desired.

Did you worry about money growing up?

No.

Do you worry about money now?

Yes, sometimes. My parents had a much higher socioeconomic status when I was growing up than I have now. My husband and I are comfortable, and he just started a new job that came with a large pay increase, so we are doing better than most Nova Scotians, but the cost of living here is skyrocketing, and my salary is very low. I support autistic people and their families, which is financially undervalued work, but I love my job.

At what age did you become financially responsible for yourself and do you have a financial safety net?

Probably around 25. My parents helped me out with school and rent in my early 20s.

Do you or have you ever received passive or inherited income? If yes, please explain.

I had an allowance in high school, and my parents paid for my undergraduate degree and rent while I was in university. Even now, my mom loves to buy things for my son, so I rarely purchase clothing or toys for him. My parents also gave us $20,000 for our home when we bought it, and my husband’s parents gave us $10,000. When my husband’s dad died, his mom also gave us $10,000. We are very fortunate to have family who supports us so much.

Day One

5:30 a.m. — I wake up to my 20-month-old son, C., rubbing my face and saying “Mama, Mama.” Cute but it’s too early. We cosleep sometimes, and it’s cozy. After 15 minutes, I give up on trying to get him back to sleep and bring him downstairs for breakfast. I make us oatmeal with soy milk, peanut butter, chia seeds, and raspberries, then brew a pot of coffee.

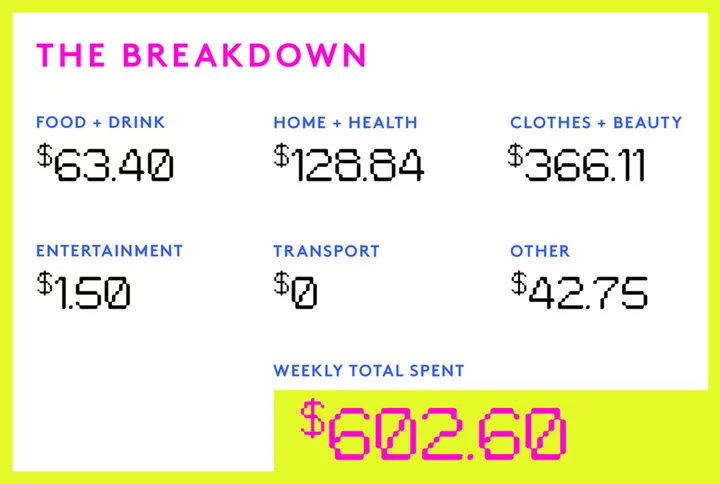

7:15 a.m. — A friend just had a baby, so I hop on Amazon (boo!) and purchase a few items from her registry. $42.75

8:15 a.m. — I drive my son to daycare and am late for working from home despite the early start. Impressive! Three cheers for my time management skills! I’m online and writing a report by 8:35.

12 p.m. — I head to a boxing class at my gym. I want to cancel because I have a lingering sinus infection, and my face hurts, but the workout ends up being really fun.

1 p.m. — I quickly shower and get back to work. I set up in my backyard and have lunch while working: Costco dill pickle salad with leftover grilled chicken.

4:30 p.m. — T. goes to pick up C., then we walk to the playground near our house.

6 p.m. — T. grills steak and asparagus, which we eat with leftover pasta salad. C. eats everything! We’re lucky that he’s not a picky eater.

8 p.m. — Bedtime for C., after which I drink a local cider and read my book, One True Loves by Taylor Jenkins Reid. I treat myself to Advil Cold & Sinus, then pass out on the couch.

10:30 p.m. — I wake up, wash my face, complete my lazy skin-care routine of Cetaphil cream from the tub and Peter Thomas Roth eye cream, then go to my actual bed.

Daily Total: $42.75

Day Two

7:30 a.m. — C. mercifully sleeps in a little. T. gets up with him, because I did yesterday. I drink coffee in bed and read until I get hungry. Breakfast is vanilla Greek yogurt, raspberries, and muesli. My friend texts me that she and her BF just had sex in his grow op. I miss pre-baby antics.

10:30 a.m. — We go to the farmer’s market and get two empanadas from the Chilean people we love ($10.57, plus $2.25 tip), a cinnamon roll, and a corn and lime bun ($7.55, plus $1.50 tip). Everything is delicious, and C. eats most of the cinnamon bun, which isn’t great. I also throw $1.50 in the basket of a woman playing a harp. C. is entranced. $22.37

12 p.m. — I put C. down for a nap and do some cleaning.

3 p.m. — I drop off C. at my parents’ place, so T. and I can grab a late lunch. We both get fried chicken sandwiches on brioche with iceberg lettuce, gouda, red onions, Parm, and some sort of magic spicy-sweet sauce. I get an iced tea, and T. gets a beer. I got a gift card for this place for my birthday, so most of the meal is taken care of. I only pay the remaining balance and a 20% tip. $19.92

4 p.m. — I get my nails done. I choose bright royal blue shellac for my toes and OPI Bubble Bath for my hands. I really hate shellac on my fingers for some reason and haven’t had it on my feet before but decide to give it a try! I pay cash for the service to avoid paying tax. I also add a $20 tip. $90.67

5:30 p.m. — I head back to my parents’ place to hang. I feed C. butternut squash mac and cheese. We head home shortly before 8, and T. puts him to bed.

10 p.m. — I have a sneaky English muffin with PB and banana because I’m just now feeling hungry again after lunch. I’m asleep (in my bed) by 11:30.

Daily Total: $110.59

Day Three

7 a.m. — Wake up. Bring C. down and make us breakfast: peanut butter oatmeal with berries. Brew coffee. C. helps me unload the dishwasher and is SO proud of himself.

10 a.m. — I head to a boot camp and get my butt kicked.

11 a.m. — Home, shower, and eat a leftover empanada with scrambled eggs. Feed C. scrambled eggs with cheese and veggies and put him down for a nap. I bake banana bread and prep sesame tofu for lunches during the week.

4 p.m. — T. takes C. to Home Depot so I can clean. When they get home, my parents and their dog come over, and we barbecue chicken, which we eat with roasted potatoes, salad, and chocolate cake my mom brought over. C. loves on their dog.

8 p.m. — Put C. to bed and tackle the laundry mountain. I’m in bed with my face washed by 10:30.

Daily Total: $0

Day Four

7 a.m. — I wake up and bring C. down for Greek yogurt and banana bread. I drop him off at daycare en route to the office.

12 p.m. — I eat the lunch I brought from home: sesame tofu with salad and a Diet Coke. I regret not packing a little treat. It’s POURING out, and I’m not motivated enough to go buy a cookie.

2:40 p.m. — I leave work to go to a client’s home. En route, I stop to buy a shelving unit for toy storage in C.’s room (found on Facebook Marketplace). The woman I buy it from is sweet, but her dog is scary and gets out during the exchange. He growls a lot and ends up mouthing my wrist but not biting me, thankfully. She is very apologetic. $90.66

5 p.m. — I stop on my way home for nasal spray ($10.84, so pricy!) and popcorn ($2.75). $13.59

6 p.m. — I planned on making curry for dinner, but we’re out of curry powder, so I end up making some sort of weird cheeseburger bowls with ground beef, rice, pickles, peppers, corn, onions, cheese, and burger sauce. They’re delicious.

8 p.m. — It takes C. an hour to go to sleep, ugh. I comfort myself with a melatonin gummy and John Oliver on the couch. It’s been raining all day, and I’m feeling very bleh.

10:30 pm. — In bed with a new book, The Christie Affair by Nina de Gramont.

Daily Total: $104.25

Day Five

8:30 a.m. — I sleep poorly and wake up grumpy. Banana bread, yogurt, and coffee for breakfast. I drop C. at daycare and am online on time.

11:30 a.m. — I bop to a local salon for a lash lift. My friend works at an ophthalmology clinic and snagged me some samples of bimatoprost, which is the active ingredient in Latisse. I’ve been using it for a few months, and my lashes are very long but still pretty straight. The lift helps give me Bambi lashes — I love it! I bought a gift certificate for the service a month ago when the salon had a promo on. I leave $11.33 as a tip. Head home, have leftovers for lunch, and work all afternoon. $11.33

5:30 p.m. — We take C. to swimming lessons. It’s T.’s turn to go in the pool. C. LOVES the water, and it’s cute and fun to watch. When we get home, we have chicken, rice, and broccoli stir-fry for dinner.

8 p.m. — T. puts C. to bed, and I’m in bed early, too, asleep by about 10.

Daily Total: $11.33

Day Six

5:30 a.m. — I wake up to C. crying in his room. I scoop him up and bring him into our bed for snuggles.

7 a.m. — I feed everyone breakfast, drop C. off at daycare, and go to the office for 8:30. I’m client-facing this morning.

12:30 p.m. — After leftovers for lunch, I go to a Botox appointment. This is my second time getting it in my forehead, and I love how subtle and refreshed it makes me feel. I had my first appointment four months ago, so I feel ready for a top up. This is going to make my week very expensive, whoops! I go home and make a smoothie with PB, soy milk, chocolate whey powder, and a banana. $264.11

4:45 — I take C. to speech therapy. He has an expressive language delay but is making progress! This is 100% covered by insurance.

6 p.m. — We have breakfast for dinner. C. goes to bed at 8, and I read some more, do a face mask, and am asleep by 11.

Daily Total: $264.11

Day Seven

7 a.m. — Wake up, feed myself and C. yogurt and berries, drop him off at daycare, and it’s off to the office I go. I am writing all morning.

12 p.m. — A coworker who’s on maternity leave comes to visit with her 11-week-old baby. He’s adorable and super happy. We go across the street to the food court, and I grab a slice of chicken Caesar pizza with kale, bacon, and garlic dressing ($4.90 + $0.75 tip). From the bougie grocer nearby, I also grab honey-mustard pretzels and coconut-rolled dates. They cost me a whopping $13.21. Desk snacks are a necessary evil. $18.86

3 p.m. — I’m off to a client’s home. On the way, I stop to buy a large bottle of sinus medication for my throbbing face (I have been COVID testing all week, and it’s not COVID). I also grab a bag of fuzzy peaches and a lime soda water. I have a great session with my client and their family. $27.34

6 p.m. — T. makes BBQ chicken pizza for dinner. C. loves it. T. puts him to bed because my friends, N. and K., are coming over. N. lives across the street and K. used to live two doors up the street but moved a five-minute drive away, which feels like an eternity. We share a bottle of wine and plot summer vacations. It’s a nice hang.

Daily Total: $46.20

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.