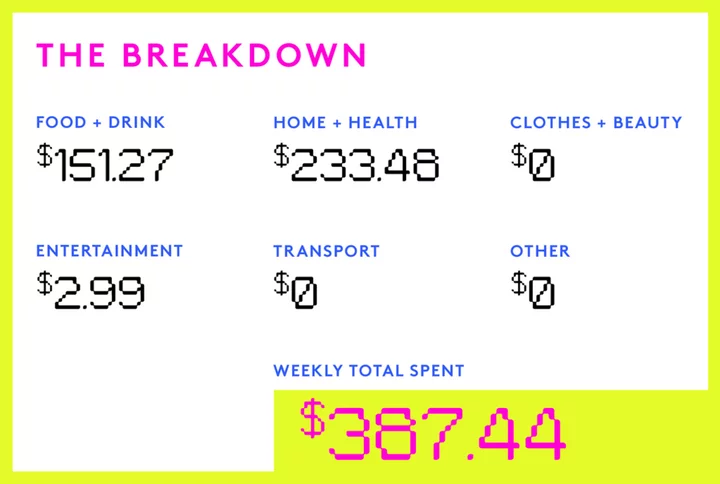

Welcome to Money Diaries where we are tackling the ever-present taboo that is money. We’re asking real people how they spend their hard-earned money during a seven-day period — and we’re tracking every last dollar.

Today: an office manager who makes $45,000 per year and spends some of her money this week on JP Licks ice cream.

Occupation: Office Manager

Industry: Construction

Age: 25

Location: Boston, MA

Salary: 45,000

Net Worth: -$25,000 ($3,000 in savings, car, value, and business revenue. My parents and I acquired a company at the beginning of the year and we’ve had a little bit of profit I’ve been able to save. Minus debt.)

Debt: $28,000 left of the $50,000 loan I took out to pay for my business.

Paycheck Amount (weekly): $750

Pronouns: She/her

Monthly Expenses

Rent: $850 (I live at home and this my half of the rent).

Loan: $1,400 (I pay $4,000 a month towards my business loan. This almost always comes from profit from the company (averaging $5,000 a month), but I like to have an extra $1,400 set aside in case profits are less, so I consider this a monthly expense).

Health Insurance: $300 (pre-tax).

Gym: $40

Amazon Prime: $15

Wi-Fi: $110

Cell Phone: $95

Utilities: $150

Car Insurance: $310

Hulu: $15

Was there an expectation for you to attend higher education? Did you participate in any form of higher education? If yes, how did you pay for it?

There was an implicit expectation. My siblings are much older than me and two of the three of them went to college. I was never told I had to, but I always assumed it was what I would do. I started working really young after high school, then I took a gap year to work and decide which degree I’d like to pursue. I am still working on my degree and taking a few classes at a time while I work. Up to this moment, I’ve been paying for school with my own money, from savings and paychecks. My parents help me sporadically with the payments when needed, but I don’t like to ask so much because they already help with many other things.

Growing up, what kind of conversations did you have about money? Did your parent/guardian(s) educate you about finances?

My parents were always big on savings and not spending money on unnecessary things. They never bought a brand new car, or things that lose value easily, but always invested in things that were solid and would bring revenue, instead of depreciation. And they’ve always told me to follow that same path with money.

What was your first job and why did you get it?

My first job was as a marketing assistant doing assistant office work. It was an after-school job in high school, 15 hours a week and I would get $250/week for it.

Did you worry about money growing up?

Not really. My parents were always prepared for things because they both came from families that were far from wealthy. We were not wealthy, but always cautious. So, they would just say “things are tight right now, let’s not buy this right this second,” but these attitudes never made me worry, just made me rethink if what I wanted was really necessary. I never wanted for anything necessary.

Do you worry about money now?

I do worry about it now because earlier this year my parents and I acquired a neighbor’s cleaning company as a way to make additional income. They helped me with the initial payment, but I make the monthly payments alone. It seemed like a good deal, but the monthly payments sometimes catch us by surprise; even though the company makes money every month, if something changes, we need to have money on our own to cover it. And we have employees who can’t have their paychecks delayed.

At what age did you become financially responsible for yourself and do you have a financial safety net?

After I left high school and started working full time, I started to have more financial responsibility even though I was/am living with my parents. I took over most of the household fixed expenses because they’re older now and I don’t want them being overworked when I can help out with some things.

Do you or have you ever received passive or inherited income? If yes, please explain.

At the moment, the only sort of passive income I have is what is left from the company’s monthly paycheck, when there’s something left. I’ve never inherited anything.

Day One

6:30 a.m. — I wake up at 6:30 on a Monday morning for work. I always make breakfast at home. Today I have a strawberry smoothie, a grilled cheese sandwich, and an apple. I also cook lunch to take to work. I drive half an hour to the office.

8 a.m. — On my way to work I stop by the gas station to fill my tank up. I get to the office and work straight until lunchtime. $40

2 p.m. — I brought rice, beans, kale salad, and shredded beef for lunch. I am Brazilian, so rice and beans are always a must for lunch. I eat while watching What We Do In The Shadows.

5 p.m. — After work, I go to a tennis class that I take with a friend, we split the cost. I drive home and chill for the rest of the night. $50

Daily Total: $90

Day Two

6:30 a.m. — Same routine — get up, prepare breakfast, and eat in the car while driving to work.

8 a.m. — Get to work and work until 2, when I heat up my lunch. I don’t have anything to drink, so I go to the building’s vending machine and get a Dr. Pepper. $3

5 p.m. — On my way home, I stop at the grocery store, I like going to Aldi. The prices are good and so is the quality of the products. I buy a gallon of milk, two cartons of strawberries, bananas, hamburger buns, burger patties, and a gallon of cranberry grape juice. I try to cook burgers at home when I can, since I have a very sensitive liver, especially with greasy food. $54

7 p.m. — Get home from grocery shopping and take a quick shower because I have church rehearsal at 8. I’m playing piano for an upcoming wedding, so we are rehearsing all the songs today.

10 p.m. — Get home from church, eat an apple, and then watch a little bit of Friends until I fall asleep around 11:30.

Daily Total: $57

Day Three

8 a.m. — I arrive at work as usual, a lot of traffic since the Sumner Tunnel is closed until the end of August, but I can still make it on time. My boss is very flexible but I always try to be on time, even knowing that most of the time he’s not at the office. I still have some strawberry smoothie left, so I drink it while working on the payroll for the week.

12 p.m. — I get hungry earlier than usual, so I heat up my food. I spend my lunch watching How I Met Your Mother on Hulu and then get back to work.

4:30 p.m. — Finally free! Or so I thought. One of the employees from my cleaning company calls saying that she needs some supplies, so I leave work and go to Lowe’s to get her what she needs. I left my company card at home so I put it on my personal card, but I will expense this ($72 expensed).

9 p.m. — I stop by Panda Express on my way home. I get a medium box of chow mein, a small box of orange chicken, and three crab rangoons. I eat in the car since I’m so hungry. Drive home, shower, bed, and that’s it. $16.72

Daily Total: $16.72

Day Four

7 a.m. — Normal morning, smoothie and work commute.

2:30 p.m. — I break for lunch, which I brought from home again. I see that one of the Funko Pops I pre-ordered was shipped, so the money has left my account. I bought some Ted Lasso Funko Pops and am very excited to add them to my humble collection. $72.56

4:30 p.m. — I’ve been looking for a bike to start doing trails again. I find a Trek bike in pristine condition on Craigslist, so I scheduled a meet-up with the person. I love the bike. My boyfriend comes with me and looks at a bike as well. He can’t afford his all the way so I pay for my bike ($300) and $50 of his bike. $350

5:30 p.m. — I get home quickly, grab a quick bite to eat, and then go for a bike ride. I stop by Dick’s Sporting Goods trying to find an excuse to spend money on accessories for my new bike, but I don’t find anything interesting. When I get home, I browse Temu and get padded biking shorts, a bike speedometer, a lock, a phone holder, and a water backpack. Then I head to church. $51.89

10 p.m. — I get home from church and go to bed.

Daily Total: $474.45

Day Five

8 a.m. — TGIF! I get to work and see my paycheck has hit so I do my payday routine. I put $100 directly to my savings then the rest goes to the two credit cards I use. I have $195 on one credit card and $450 on another. I pay off the $195 and put $300 on the second one, so I still have something on my bank account. I don’t usually keep a balance on my credit cards and plan to pay them both off in full by the end of the month.

12 p.m. — Lunch break as always with TV and food from home.

4:30 p.m. — I go home to watch some TV. I make a burger and eat it while drinking cranberry grape juice. After a few hours of hanging out, I go to bed.

Daily Total: $0

Day Six

12 p.m. — I usually sleep in on Saturdays, but even for me, this is late. I get up, eat a banana and start prepping lunch. We have beans and rice, so I made some Brazilian-style pasta with beans and salad. After lunch, I shower and wash my hair. Then I get ready since my friend who is visiting is coming over and I’m going to show her around Boston. My friend, R., arrives and we chat for a bit.

3 p.m. — I leave with R. and we’re planning on taking the T downtown. I don’t like to take the bus from home, because it takes so long on a Saturday, so I take the car and park it at the station (free parking for three hours). We take the train downtown and I pay $4.80 for the inbound and outbound rides. $4.80

4:30 p.m. — As expected, we don’t take more than three hours for the tour. I am not the right person for these tasks because I don’t like walking around too much. We get back to my home station and go to JP Licks to get ice cream. I get a cup with two scoops and a cone on top. Then I say goodbye to R. and head home for a night in. $8.31

Daily Total: $13.11

Day Seven

11 a.m. — It’s Sunday and I’ve slept in again. This is my first weekend in forever that I don’t have work or school. I work a full-time job, have our side business, and I took a summer class in economics at my university. The course was actually free and is required to graduate. My major is mechanical engineering and I’m still working towards my degree.

1 p.m. — After lunch, I’m feeling a little nappy, so I take a nap. I wake up, chat with my sister, then hop in the shower. Then, I head to church for rehearsal.

8:30 p.m. — My boyfriend and I leave church after rehearsal and a service. We’re both hungry so we stop by Panda Express. We order the same as always: chow mein, orange chicken, and crab rangoon. We also get drinks ($23.72). I pay since he doesn’t have enough cash on him. He drops me off at home and I say goodnight and go right to bed. $23.72

Daily Total: $23.72

Money Diaries are meant to reflect an individual’s experience and do not necessarily reflect Refinery29’s point of view. Refinery29 in no way encourages illegal activity or harmful behavior.

The first step to getting your financial life in order is tracking what you spend — to try on your own, check out our guide to managing your money every day. For more money diaries, click here.

Do you have a Money Diary you’d like to share? Submit it with us here.

Have questions about how to submit or our publishing process? Read our Money Diaries FAQ doc here or email us here.